Recession likely over but slog ahead

Fed chairman says he's 'confident' Congress will update rules for the financial system.

|

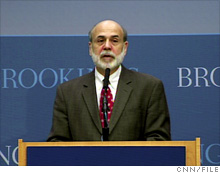

| Fed chief Ben Bernanke said he believes Congress will act on financial overhaul. |

WASHINGTON (CNNMoney.com) -- In his first speech since he was reappointed, Federal Reserve Chairman Ben Bernanke said the recession is "very likely over" but detailed the tough road ahead for the economy.

Bernanke also said that despite delays, he is confident that Congress will pass changes to financial rules to ward off future collapses.

He hit hard on the "challenges" for the Fed and all policymakers in dealing with a sluggish unemployment rate as the economy recovers from a recession that began in December 2007.

"That's one reason why, even though from a technical perspective, the recession is very likely over at this point, it's still going to feel like a very weak economy for some time," Bernanke said. "As many people will still find their job security and employment status is not what they wish it was."

Bernanke's speech to experts and Washington insiders at the Brooking's Institution in Washington on Tuesday was a repeat of the one he gave to economists in Jackson Hole, Wyo., last month, when he cautioned the economy would start growing again, although slowly.

While answering questions, on Tuesday, Bernanke said the pace of recovery in 2010 would be "moderate" and added that the unemployment rate would come down "quite slowly," due to "headwinds" on ongoing credit problems and the effort by families to reduce household debt.

Stock investors took note of Bernanke's remarks, and the leading measures moved slightly higher.

Bernanke also said he believes Congress will pass changes to the nation's regulatory structure, while acknowledging that the effort had been slow-going.

"While maybe the focus on regulatory reform in the Congress has not yet been as intense as I expect it will be ... I feel quite confident that a comprehensive reform will be forthcoming," he said.

Bernanke played down concerns that turf wars between regulatory were getting in the way of legislation. "There are legitimate interests and there are interests that are more self-interested ... and that's just true with everybody, including all the members of Congress involved in the discussion," he said.

He said one proposal that he advocates "has nothing to do with the Fed's own powers" -- that's the creation of a new type of power, called "resolution authority," to unwind giant financial firms whose failure puts the economy at stake. Current proposals would give that power to the Federal Deposit Insurance Corp., since it already monitors and unwinds bad banks.

The economic downturn and slow recovery were also the subject of remarks Tuesday by President Obama. Obama spoke to employees at an assembly plant in Lordstown, Ohio.

"There's little debate that the decisions we have made and the steps we have taken have helped stop our economic free fall. In some places, they've helped us turn the corner," Obama said. "It's going to take some time to achieve a complete recovery." ![]()