Madoff Ponzi prosecutors: Still trying to tally loss

Judge Denny Chin drops his demand that prosecutor prove how much Madoff stole.

|

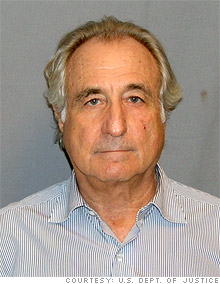

| Ponzi convict Bernard Madoff, shown here in his mugshot, is serving a 150-year sentence. |

|

| Madoff's yacht, "Bull," was seized by authorities. |

NEW YORK (CNNMoney.com) -- The world may never know how much money Bernard Madoff stole through his legendary Ponzi scheme.

That was the message of prosecutors in the Madoff case on Tuesday, when they explained in court papers that attempting a final tally of losses was "impracticable."

"[Bernard L. Madoff Investment Securities'] records have not yet allowed for a definitive compilation of victims or a precise computation of the amount of loss suffered by each identified victim," the prosecutors wrote in a document filed to Judge Denny Chin of U.S. district court in Manhattan.

Chin had given prosecutors until Sept. 28 to come up with a tally of damages for Madoff's multi-billion dollar Ponzi scheme, which victimized thousands of investors. But on Thursday, Chin dropped this requirement and released a ruling saying "that the number of identifiable victims is so large as to make restitution impracticable."

Madoff's Ponzi scheme has been widely reported as totaling $65 billion. But this is not how much money he stole, according to investigators. It is the amount of money that he fraudulently claimed to have made through investments, in printed statements to his victims.

The U.S. Attorney's office in Manhattan said that, as of Sept. 22, the losses of 2,336 victims exceeded $13 billion. "The process of analyzing customer losses is ongoing," prosecutors said, in a document filed to the court.

Madoff, 71, was arrested on Dec. 11, 2008 for perpetuating a decades-long scheme, in which he courted investors through one of his Manhattan-based firms. But as Madoff later admitted in court, he was not investing his clients' money, but stealing it. His business was a front for a Ponzi scheme, in which he used fresh money from unsuspecting investors to make payments to more long-standing investors, creating the false appearance of legitimate returns.

On March 12, 2009, Madoff pleaded guilty to 11 federal counts related to his scheme. He was sentenced to 150 years on June 29. He is currently incarcerated at the Federal Correctional Institution Butner in North Carolina.

He is also being forced to forfeit property to comply with a $170 billion legal judgment against him.

So far, U.S. Marshals have seized his $7 million apartment on Manhattan's Upper East Side and his houses in the tony towns of Montauk, N.Y., and Palm Beach, Fla., as well as vehicles and yachts.

The value of these and other forfeited properties are being tallied for distribution to Madoff's victims by the court-appointed trustee, Irving Picard.

The prosecutors said, in the documents, that about half of Madoff's victims "did not sustain a net loss," meaning that they cashed out at least as much money as they'd invested with him while his business was still operating.

Ilene Kent, the New York-based coordinator of the Madoff Survivors' Group, disagreed with how the prosecutors define "net loss" or equity, and said that investors who withdrew money from Madoff are still considered victims.

"Even though they say that [the victims] took money out, they took money out based on what they thought was in [their] account," said Kent. "You lived your life according to what you thought you had."

Ken Rubinstein, an asset protection lawyer who is not involved in this case, said the complex nature of asset distribution in this case is one of the reasons why prosecutors backed off from producing a final tally.

"The basis for that position is that there is extensive litigation ongoing as to how to define the loss," said Rubinstein. "The definition of loss is very much a disputed definition right now."

When asked about the ruling, Madoff attorney Ira Lee Sorkin said, "My only comment is: It's not surprising." ![]()