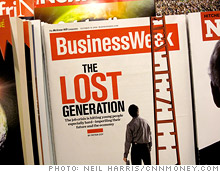

Bloomberg buys BusinessWeek

The financial news and data company, founded by New York City's mayor, will take 80-year-old magazine off McGraw-Hill's hands. What's next for BusinessWeek is unclear.

NEW YORK (CNNMoney.com) -- Looking to expand its reach beyond Wall Street, Bloomberg LP said Tuesday it would buy BusinessWeek magazine from McGraw Hill Cos.

Bloomberg, founded in 1981 by New York City Mayor Michael Bloomberg, is purchasing the 80-year-old weekly newsmagazine to tap into its audience of decision makers around the world. Terms of the agreement were not disclosed, but reports say Bloomberg is paying up to $5 million.

Though it has a presence on the Web, radio and television, Bloomberg primarily transmits financial information through 300,000 proprietary terminals that are a mainstay in investment banks and financial firms worldwide. It also publishes a monthly magazine.

"BusinessWeek helps better serve our customers by reaching into the corporate suite and corridors of power in government, where news that affects markets and business is made by CEOs, CFOs [chief financial officers], deal lawyers, bankers and government officials who typically are not terminal customers," said Daniel Doctoroff, president of Bloomberg.

McGraw Hill (MHP, Fortune 500), owner of Standard & Poors rating agency, put BusinessWeek up for sale as advertising plummeted. Financial magazines saw their ad revenue sink 40.6% in the first nine months of the year, far more than the 20.3% drop for the magazine industry overall, according to Publishers Information Bureau. Several bidders expressed interest.

Bloomberg's plans for the newsweekly remain unclear, though BusinessWeek's powerful brand will likely remain in some form. This is Bloomberg's first acquisition, though it has made deals with print publications to distribute its stories.

"The acquisition of BusinessWeek will strengthen Bloomberg's online, television and mobile products," said Bloomberg Chairman Peter Grauer. "We also expect to build Bloomberg Television content around the powerful BusinessWeek brand and its world-class journalists."

The BusinessWeek sale comes on the heels of Conde Nast's shuttering of four magazines, including the venerable Gourmet. Beset by falling ad revenue and readership, the magazine industry has been closing titles and laying off workers during the economic downturn. ![]()