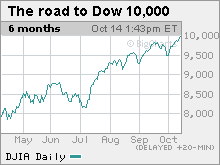

Don't trust Dow 10,000

The stock market is supposed to be a leading indicator, predicting what happens next. But the rally doesn't mean the nation's economic woes are over.

NEW YORK (CNNMoney.com) -- As the Dow closed above 10,000 for the first time in more than a year Wednesday, economists cautioned that the blue-chip average shouldn't be seen as giving a green light to the economy.

The stock market is what is known as a leading economic indicator, as investors place bets on how strong they believe company results and the broader economy will be in the near future.

Lately, there has been a growing consensus among both investors and economists that the battered U.S. economy hit bottom and turned around earlier this year, and is now in a recovery.

The Federal Reserve said economic activity has "picked up" in its statement after its Sept. 23 meeting, and about 80% of leading economists surveyed by the National Association for Business Economics agreed in a survey earlier this month that the recovery has begun.

But even economists who agree the economy is in recovery say that growth will be slow and difficult, with continued job losses, tight credit and further declines in home prices. And even some who believe that the current Dow 10,000 level is justified say there's still a significant risk that the economy will take a step backward.

"One of the great challenges is whether consumers and small businesses come along with this recovery," said John Silvia, chief economist with Wells Fargo. "If they don't, you either sit at 10,000 or slip back to 9,500. To sustain another double-digit (percentage) gain to Dow 11,000 is asking too much from this economy and the risks we still see out there."

There are also economists who question whether the economy is truly in recovery, given that it continues to lose about a quarter-million jobs a month. They say the more than 50% rally in the Dow since it closed at a low of 6,594.44 on March 5 is only a reflection that the fear of the economy toppling into a full-fledged depression has abated.

"We're not at Armageddon anymore, so of course you should have some kind of rally," said Rich Yamarone, director of economic research at Argus Research. "But I think there's a bubble-like atmosphere going on here in the rush back to 10,000. Caution should rule the day. We're not out of the woods yet."

Several experts point out than many of the relatively strong earnings reports helping to lift the markets in recent days are being driven by cost cuts, rather than strong revenue growth that would be a better indicator of consumers and businesses being willing to spend again. If businesses keep cutting costs to make the numbers that Wall Street wants to see, that can only put more downward pressure on jobs and wages, and result in weaker economic growth or another downturn.

"The companies are cutting fat, and in many cases cutting bone and muscle. There's no organic economic growth there," said Yamarone.

Barry Ritholtz, CEO and director of equity research at Fusion IQ, said that despite their reputation as a leading indicator, the stock markets do a terrible job forecasting the economy.

"Beware of economists pointing to the stock market," he said. "The rallies tend to be false starts because it's a reaction to what came before. The sell-offs tend to be overdone because, as they gain momentum, they lead to panics."

Ritholtz said comparisons of current earnings to those of a year ago or stock levels to the lows of earlier this year greatly exaggerate the strength even the market sees in the economic outlook.

"It's like saying the Detroit Lions have better year-over-year comparisons because they're no longer winless," he said about the football team that went 0-16 in 2008, but has won one of five games so far this year. "But they're still in last place and they're not winning the Super Bowl."

Another reason that comparisons to Dow levels of a year ago are risky is that two of the more troubled components -- General Motors and Citigroup (C, Fortune 500) -- were dropped and replaced by stronger companies such as Cisco Systems (CSCO, Fortune 500) and Travelers Cos. (TRV, Fortune 500) in June.

Without those changes the Dow would be almost 100 points lower now than it is with the stronger companies, although precise comparisons are difficult since GM shares are no longer traded on the New York Stock Exchange.

"You take out the worst, put in the best, and by definition you'll get better numbers," said Yamarone. ![]()