Fending off empty holiday shelves

Tight credit and slow sales are putting retailers in a crunch on financing their inventory.

|

| Karen Zebulon, owner of Gumbo, is using a loan from Seedco Financial to stock up on toys for the holiday season. |

|

| Jessica Furst is the owner of Artez'n Gift and Gallery, an Atlantic Ave. retail store that sells products made by Brooklyn artisans. |

|

| Furst used a holiday loan to stock up on one of her most popular gift items: pint glasses with Brooklyn landmarks on them. |

|

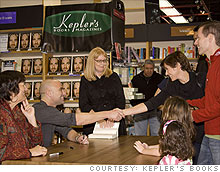

| Kepler's Books is a cultural mainstay of the Menlo Park, Calif., community. |

|

| Montanta Fish Company wants to expand and hire more workers, but can't land the loan it needs. |

NEW YORK (CNNMoney.com) -- With sales slow and credit tight, small merchants are scrambling to stock their shelves for the year's biggest shopping season.

Retailers traditionally borrow money to buy holiday inventory. But credit for small businesses has dried up this year, and with the recession slowing sales, few merchants have cash on hand. The crunch is forcing business owners to find new ways to keep running.

For a handful of New York City retailers in one hard-hit stretch of Brooklyn, a small community lender is playing the role of Santa Claus. Lesia Bates Moss, president of Seedco Financial Services, noticed an ever-increasing number of vacant storefronts along Atlantic Avenue. In response, she hosted a meeting with a dozen area retailers to find out how her organization could help.

One common problem the merchants cited was getting enough credit to buy sufficient holiday inventory. So Seedco Financial, a nonprofit that specializes in financing for underserved communities, launched a streamlined holiday program: Retailers who could provide a marketing plan for spending the money and driving foot traffic would get fast loans.

On Monday, Seedco staffers started delivering checks. A typical loan request is for around $20,000, to be repaid over the next year at interest rates of 6% to 10%.

"It doesn't take a lot in the way of capital access to help these businesses," Moss said. "We really needed to get money into the hands of these merchants before Black Friday, so they could stock their stores."

Toys and beer glasses: Karen Zebulon, the owner of toy and clothing retailer Gumbo on Atlantic Ave., is one of Seedco Financial's borrowers.

"Especially this year, because we have had such hard times, we really need a boost," she said. "If I can really strategize and plan and buy the right merchandise, I think it can be a turning point for me."

Zebulon plans to ramp up her inventory of toys, because even in tight times, customers continue to spend on kids. She's impressed at how quickly Seedco Financial got cash into her hands.

"This was -- you could say -- a godsend," she said. "It is saving me and saving a lot of other merchants that are receiving the loans." Without the financing, she would have been pulling a string of all-nighters trying to handcraft toys to stock her shelves.

Artez'n Gift and Gallery, which sells products made by local Brooklyn artisans, also got a loan from Seedco. Owner Jessica Furst got her check on Monday and "ran to the bank." She plans to use the cash to stock up on one of her best-selling items: pint glasses with illustrations of Brooklyn landmarks on them. They're a proven customer lure, drawing in tourists and others who make a special trip to Artez'n for the glasses.

With sales slow this year, Furst wouldn't have been able to afford to produce the Brooklyn beer glasses without the last-minute loan. "I would have been without them again, which would have been a loss of income for me, and possibly a loss of customer base," she said.

She will also use some of the loan money to fix the high-end printer she uses for her graphic design business. The small loan will make a big difference for Furst: "It will enable me to get back on my feet."

The big challenge for merchants will come over the next month. The National Retail Federation forecasts that this year's holiday sales will decline 1%, to $437.6 billion.

"The real concern is, can you sell stuff?" said Bill Dunkelberg, chief economist of the National Federation of Independent Businesses. "I am sure inventory accumulation has been cautious. It doesn't look like it is going to be much better than last year, which was terrible."

Squeezing by: Not every retailer is lucky enough to have a community lending program to turn to.

Clark Kepler's dad opened Kepler's Books in 1955. Like so many other independent bookstores, Kepler's Books is fighting for sales in an industry now dominated by Big Box discount retailers and Internet book sellers. Four years ago, with the shop on the brink of closure, 25 members of the Silicon Valley community voluntarily donated $1 million to save the neighborhood bookstore.

The recession has further ravaged the business, which saw a double-digit sales decline. "We had the most difficult time this last several months with the cash-flow issues," Kepler said. "We managed to get through it, but we were robbing Peter to pay Paul every step of the way."

One way the shop is coping is by churning inventory faster than it typically would. Bookstores can return unsold goods to publishers, and Kepler is shuffling fast to fine-tune his holiday lineup.

"It is a mad scramble much of the time," he said. "We have needed to scrutinize our inventory more and more to be sure that we have books that are selling." A book that languishes is "like money sitting on the shelf that we are not utilizing."

Kepler could use additional financing to give his bookstore more breathing room, but he's had little luck with the banks. He talked with one lender about a Small Business Administration-backed loan, but pulled out after deciding that the loan available for his shop wouldn't be big enough to justify all the effort involved in the application process.

Kevin Stein, co-owner of the Montana Fish Company in Bozeman, Mont., is also frustrated with the banks. "We have been to every bank in town," he said. "If we could expand into a bigger facility, we could take on more business, we could hire more people -- it is a win-win."

But so far, with no expansion loan yet available, Stein's seafood and wine market isn't doing its usual seasonal hiring. "We didn't lay anyone off, but it was a combination of not rehiring and not hiring for the holiday season," Stein said. To make up for the staffing decrease, Stein and his co-owner have upped their own hours.

"As employees filtered out, we just simply didn't rehire, which means I spent a lot less time at home," he said.

Like the merchants that borrowed from Seedco Financial, Stein is now looking outside the banking industry for help. He's trying to get a loan directly from the Small Business Administration, through its disaster lending program. A natural glass explosion one block away from Montana Fish may make the company eligible.

Stein and his business partner, Travis Byerly, have been pulling together mountains of documentation.

"It is a little mind-boggling," Stein said of application process. "But it is a great loan if we can get it. It could be a game changer." ![]()

-

The Cheesecake Factory created smaller portions to survive the downturn. Play

-

A breeder of award-winning marijuana seeds is following the money and heading to the U.S. More

-

Most small businesses die within five years, but Amish businesses have a survival rate north of 90%. More

-

The 10 most popular franchise brands over the past decade -- and their failure rates. More

-

These firms are the last left in America making iconic products now in their twilight. More