Search News

President Obama will donate the $134,000 advance and other proceeds from his 2010 children's book "Of Thee I Sing."

WASHINGTON (CNNMoney) -- A big portion of President Obama's wealth is invested in federal debt, according to a financial disclosure form released Monday.

The president and First Lady Michelle Obama had assets valued between $2.8 million and $11.8 million in 2010.

And between $2 million and $10 million of their assets are invested in super-safe U.S. Treasury securities, according to the disclosure form. That's up from $1.5 million to $6 million reported invested in Treasury notes and bills in 2009.

The report uses broad financial ranges, making a more precise accounting impossible.

The president and First Lady reported no debts.

They also have between $350,000 and $800,000 invested in IRAs and other retirement funds, according to the form.

And the couple has between $200,000 and $500,000 squirreled away in 529 college savings plans for their daughters Malia and Sasha. That's up considerably since the president took office. In 2008, the Obamas reported between $50,000 and $100,000 in such savings.

Much of the Obamas' wealth comes from President Obama's best-selling books "Dreams from my Father" and "Audacity of Hope."

Last year, the Obamas earned at least $1.1 million in royalties from books. On their 2010 tax returns, they reported an adjusted gross income of $1,728,096.

But their book royalties have dropped from 2009, when they raked in more than $5 million in royalties.

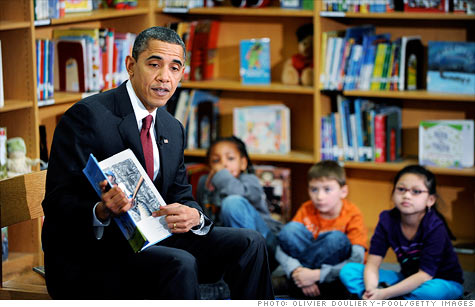

The president's children's book, "Of Thee I Sing," published last November, earned him a $134,000 advance. He is donating that money and all proceeds from the book to the nonprofit Fisher House Foundation for a scholarship for children of fallen and disabled soldiers.

Obama's annual salary as president in 2010 was $395,188.

Michelle Obama received $10,000 from a trust called the Henry G. Freeman Jr. Pin Money Fund set up for first ladies, who don't draw a salary. The fund was set up in 1917 to augment presidential salaries. ![]()

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |