Search News

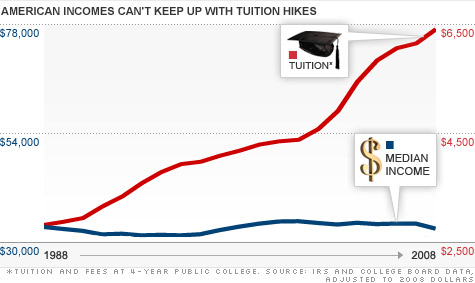

As portrayed on the left axis, median income has hovered around $33,000 since 1988. Meanwhile, college tuition and fees -- portrayed on the right axis -- have more than doubled.

NEW YORK (CNNMoney) -- What do you get when college costs skyrocket but incomes barely budge? Yet another blow to the middle class.

"As the out-of-pocket costs of a college education go up faster than incomes, it's pricing low and medium income families out of a college education," said Mark Kantrowitz, publisher of financial aid sites FinAid.org and FastWeb.com.

The numbers confirm what most middle class families already know -- college is becoming so expensive, it's starting to hold them back.

The crux of the problem: Tuition and fees at public universities, according to the College Board, have surged almost 130% over the last 20 years -- while middle class incomes have stagnated.

Tuition: In 1988, the average tuition and fees for a four-year public university rang in at about $2,800, adjusted for inflation. By 2008, that number had climbed about 130% to roughly $6,500 a year -- and that doesn't include books or room and board.

Income: If incomes had kept up with surging college costs, the typical American would be earning $77,000 a year. But in reality, it's nowhere near that.

In 2008 -- the latest data available -- the median income was $33,000. That means if you adjust for inflation, Americans in the middle actually earned $400 less than they did in 1988. (Read: How the middle class became the underclass).

Financial aid: Meanwhile, the amount of federal aid available to individual students has also failed to keep up. Since 1992, the maximum available through government-subsidized student loans has remained at $23,000 for a four-year degree.

"There does seem to be this growing disparity between income and the cost of higher education," said Justin Draeger, president of the National Association of Student Financial Aid Administrators. "At the same time, there's been a fundamental shift, moving away from public subsidization, to individuals bearing more of the cost of higher education."

Facing that disparity, it's no wonder then that two other trends have emerged: Families are taking on unprecedented levels of debt or downgrading their child's education from a four-year, to a two-year, degree to cut costs.

Student debt is often viewed as a good kind of debt, because a college education seems to promise a better future.

College grads, after all, have much lower unemployment rates than high school grads. And they earn $1 million more over their lifetimes, according to a much-quoted figure from the Labor Department . (Read: Is a college degree really worth $1 million?)

But even in this case, too much of a good thing can still be bad.

About two thirds of students graduating with four-year degrees recently did so with loans hanging over their heads, and their average bill comes in at a whopping $23,186, according to FinAid.org.

Of those, Kantrowitz estimates that about half will still be repaying their loans in 20 years -- the traditional student loan period. And for many, that may very well mean they won't be able to buy a home, save for retirement or fund the next generation's education.

"They could still be paying back their own student loans, when their children are in college," he said.

On the flip side of this problem, some families are trying to limit their student debt by opting for two-year degrees.

According to the Department of Education, the portion of middle-income students that enrolled in four-year colleges has dropped, while their enrollment in 2-year colleges has risen, over the last decade.

Many of these students, who would otherwise qualify for four-year college, are getting fewer job skills at a time when employers are demanding just the opposite.

Economists speculate that one reason unemployment is so high is because the American workforce lacks the skills needed to fill the jobs that are open. As a result, companies may shift these jobs overseas, where wages are often cheaper.

Seeing a portion of the middle class shift to two-year degrees certainly doesn't help the United States compete in the global economy.

And shrinking opportunities for the middle class don't help matters on the home front, either.

The richest tier of Americans continue to see their wealth surge, while the middle class is stuck in neutral. (Read: How the rich became the über rich)

"We're seeing further differentiation in incomes, with the rich get richer and the poor getting poorer," Kantrowitz said. "Meanwhile, the middle class often claims they're too wealthy to get student aid, yet too poor to afford college."

Are you still struggling to pay off student loans from years ago? In the end, was your college degree worth the debt? Send your story and contact information to RealStories@turner.comand you could be featured in an upcoming article on CNNMoney. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |