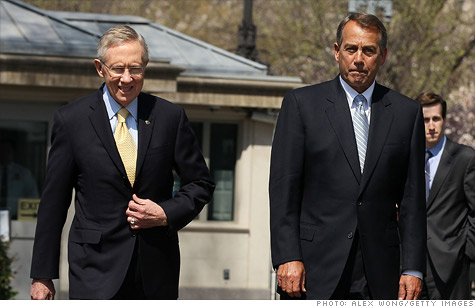

Senate Majority Leader Harry Reid and House Speaker John Boehner put out competing plans to avoid default on Monday.

NEW YORK (CNNMoney) -- The dispute du jour in the debt ceiling debate? How long a debt ceiling increase should last.

The two sides -- with a week to go before the Treasury Department says it may run short of money to pay all the government's bills -- have starkly different answers to the question.

President Obama and Democrats want an increase to last until 2013.

To that end, Senate Majority Leader Harry Reid has proposed a $2.7 trillion debt reduction plan in exchange for a $2.7 trillion increase in the debt ceiling. Such a package would not include any tax increases or entitlement cuts.

House Republicans, however, say they don't want to give Obama what they call "a blank check" just so he can avoid another debt ceiling fight during his re-election campaign in 2012.

They would rather the $14.3 trillion ceiling be raised in two steps.

The first increase of up to $1 trillion would last about six months and be accompanied by $1.2 trillion in savings achieved by cutting and capping domestic and defense spending over 10 years.

To get the debt ceiling increased by another $1.6 trillion after that, Congress would need to enact an additional $1.8 trillion in savings that don't include any tax hikes. Those savings would be chosen by a new joint committee, and the House and Senate would have to vote on the committee's recommendations without amendment.

If they vote down the committee's proposals, the debt ceiling couldn't be raised.

Treasury Secretary Tim Geithner on Sunday said he doesn't have a problem with a two-stage approach to debt reduction but worries that dragging out the debt ceiling decision could be dangerous.

"What we cannot do because it would be irresponsible is to leave the threat of default hanging over the economy," he told CNN's Candy Crowley on the "State of the Union."

Increasing the debt ceiling through the next election -- and removing the fear of default until then -- will help economic growth in the second half of this year, Geithner argued.

What certainly could impede economic growth is a credit rating downgrade, which the credit ratings agency Standard & Poor's has threatened to do in the next three months.

S&P hasn't said specifically that it would downgrade the United States if the initial debt-ceiling increase was short-term.

But it did note that continued use of the debt ceiling as a political bludgeon might trigger a downgrade.

"We may also lower the long-term rating and affirm the short-term rating if we conclude that future adjustments to the debt ceiling are likely to be the subject of political maneuvering to the extent that questions persist about Congress' and the administration's willingness and ability to timely honor the U.S.' scheduled debt obligations," the agency said earlier this month.

On the other hand, S&P and the other ratings agencies have said they won't be pleased if lawmakers fail to pull together a credible, substantial debt reduction package.

That's one reason why Douglas Holtz-Eakin, a former Congressional Budget Office director who now runs a Republican think tank, doesn't think the prospect of a short-term increase followed by a longer one would damage the economy.

The markets, he said Monday on CNBC, "want to see the debt ceiling avoid near-term disruption and see substantive progress toward controlling spending."

Another reason markets might shrug off a two-stage increase in the debt ceiling: Any action would be a sign that Congress won't let the country default, said Cumberland Advisors Chairman and CEO David Kotok.

What really may matter to the markets and the ratings agencies will be the balance lawmakers strike between the duration of the debt ceiling increase and the content of the debt reduction package paired with it.

"The worst outcome, other than a default, is a short-term extension that involves no meaningful commitment to medium-term fiscal reform," said Mohamed El-Erian, CEO of Pimco Funds, the world's largest bond management firm.

The best outcome, El-Erian noted, would be "a multi-year debt ceiling increase in the context of serious medium-term spending and tax reforms."

But that's not the solution anyone is gunning for at the moment. Instead they're aiming for "the possible."

Few relish the idea of revisiting the kind of bitter, distracting debt ceiling debate that has consumed Congress in recent months. That's why former Congressional Budget Office Director Rudy Penner said he'd much prefer a debt ceiling increase through the 2012 elections "just to delay the type of uncertainty that would be created by a repeat of this debate."

A two-stage increase could be structured so that wouldn't happen, he said. But the House GOP plan didn't strike him that way. "If the Joint Committee finds $1.8 trillion of cuts and they are accepted by the Congress, we are home-free, but what are the chances of that?"

Penner's real wish? "Have no debt limit at all, since it is an irrational law that is separate from and inconsistent with spending and tax decisions made in the past."

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |