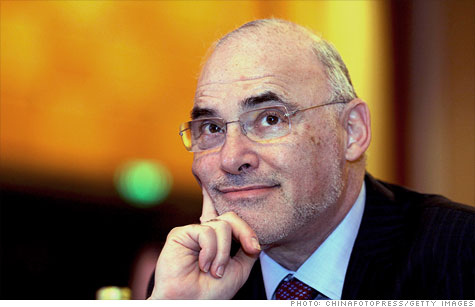

HP CEO Leo Apotheker wants to get HP out of the PC business.

NEW YORK (CNNMoney) -- Hewlett-Packard is taking a hatchet to its business and doing some radical restructuring.

The company said Thursday that it is looking to spin off its industry-leading but struggling personal computer business. HP also killed off the TouchPad tablet it launched last month, as well as its webOS smartphone line.

The move essentially leaves for dead the webOS software HP got by acquiring Palm last year, though the company said it will continue trying to "optimize the value" of its purchase. Though the move was unexpected, it's not all that surprising: Despite a huge marketing campaign, TouchPad sales struggled so much that HP almost immediately cut the tablet's price by $100. HP said none of its webOS products reached the company's internal sales targets.

HP also said it has agreed to buy British software developer Autonomy for roughly $10.2 billion in cash. At $42.11 per share, the purchase price represents a 58% premium over the company's average share price over the past month. Autonomy specializes in database search and other enterprise software technologies.

"We believe this bold action will squarely position HP in software and information to create the next-generation information platform," Apotheker said on a conference call with analysts. "This is about a transformation to position HP for a new future and driving shareholder value."

Curiously, and perhaps paradoxically, Apotheker said HP will run Autonomy as a separate company, but HP will "look for synergies."

HP's (HPQ, Fortune 500) stock fell an additional 6% in afterhours trading, after tumbling 6% during regular hours.

The share price swung wildly after reports of the PC spin-off plan first broke late Thursday morning. Shares had fallen by as much as 8% in early trading, then rebounded and shot up as high as 8% above Wednesday's closing price before falling back into negative territory.

The various moves are part of the company's stated goal of transitioning into faster-growing, more profitable businesses like software, servers and corporate technology services. But ditching its consumer businesses will come at a steep price: HP's Personal Systems unit accounts for about 1/3 of the company's annual revenue.

As a result of the transition and "challenges that we face across our businesses," HP reduced its full-year revenue forecast by 9%. It also lowered its profit forecast by 16%, though that dreadful number includes charges related to killing off its webOS products. Without those charges, HP still lowered its previous estimate by 4%.

HP Chief Financial Officer Cathie Lesjak told analysts on the call that the outlook was "definitely the toughest one for me as CFO."

The bold move to reshape HP -- the world's largest tech company by annual revenue -- would be in line with the strategic vision CEO Leo Apotheker unveiled in March.

In May, Apotheker told analysts that the company needed to put greater investment into its "value-added services" or it will "be left with a business that is running out of steam."

Consumer PC sales have slumped industry-wide for the past several quarters, as tablets like Apple's (AAPL, Fortune 500) iPad have slowed netbook and mini-notebook sales. The trend has hit HP particularly hard: sales to consumers fell 17% between May and July.

"The tablet effect is real," Apotheker said on the call with analysts on Thursday. "Consumers are changing how they use PCs."

But a move to sell off its PC unit would be a 180-degree turn for HP, which 10 years ago bought Compaq in an acrimonious deal that eventually helped cost then-CEO Carly Fiorina her job. That acquisition made HP the largest PC manufacturer in the world.

Despite its recent struggles, HP still sells more PCs than any other vendor, shipping 14.9 million PCs last quarter -- enough to give it control of 17.5% of the market, according to Gartner. Dell (DELL, Fortune 500) and Lenovo are in a near-tie for second place, each with more than a 12% share of the market and shipments in excess of 10 million units last quarter.

The company said its board of directors has authorized executives to explore "strategic alternatives" for its Personal Systems unit, including a full or partial spin-off or sale. HP said it plans on making a final decision on the division within the next 12 to 18 months In addition to PCs, that unit also makes some other consumer devices like mobile phones.

Apotheker has said that by placing greater emphasis on the company's fast-growing software and server businesses, HP can leverage those units to improve its slow-growing services division. But HP executives aren't kidding when they preach "patience" in the transition: HP's software business made up just 2% of the company's sales this past quarter.

A deep dive into enterprise software would also take Apotheker back to his roots. He was previously the head of German software giant SAP (SAP).

For the previous fiscal quarter, which ended July 31, the Palo Alto, Calif., company reported net income of $1.9 billion, or 93 cents per share up 9% from a year earlier.

Results included one-time charges totaling 17 cents per share. Without the charges, HP said it earned $1.10 per share. Analysts polled by Thomson Reuters, who typically exclude one-time items from their estimates, had forecast earnings of $1.09 per share.

Sales rose less than 2% to $31.2 billion, in line with analysts' forecasts. ![]()