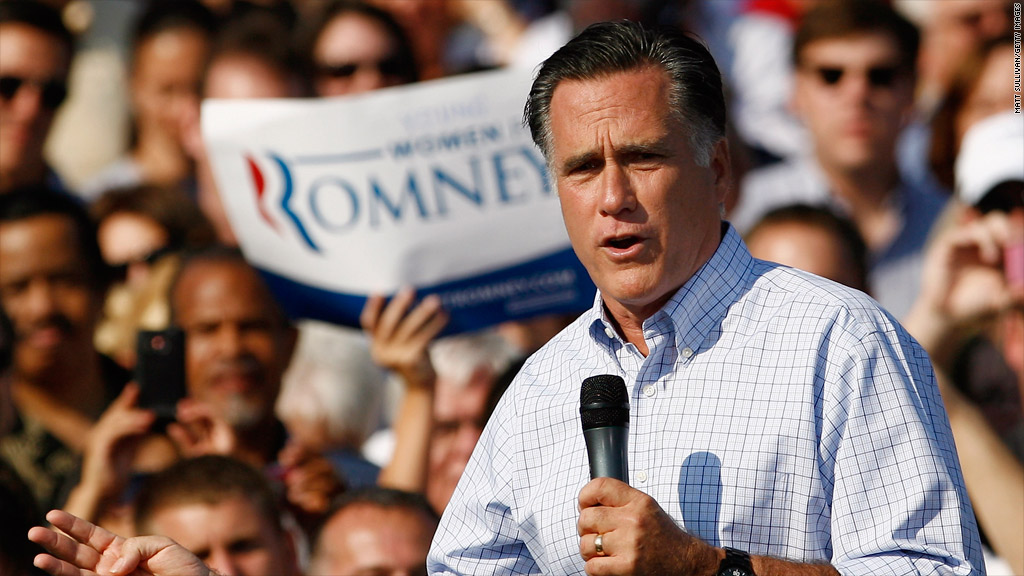

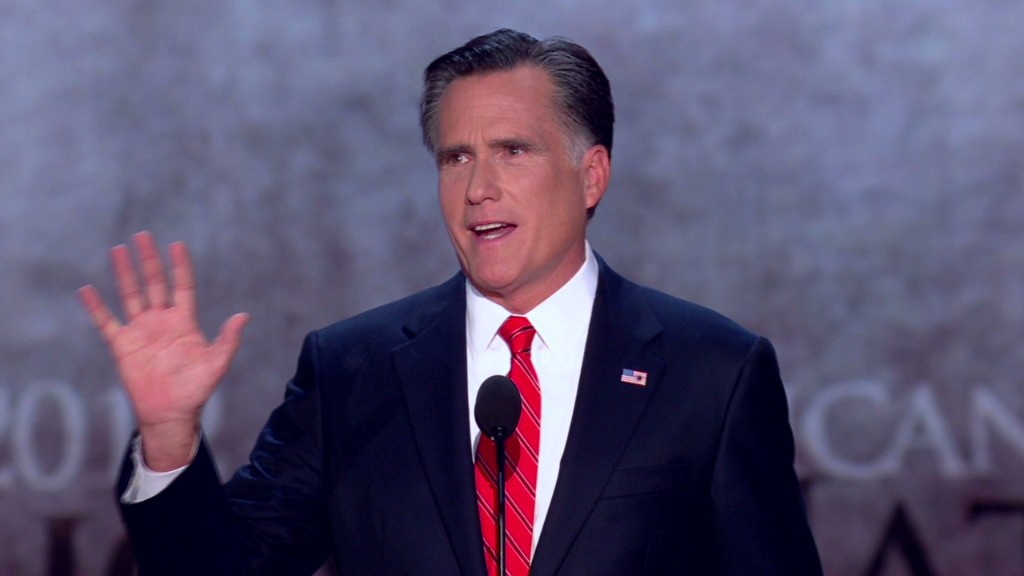

Mitt Romney made $13.7 million last year and paid $1.94 million in federal income taxes, giving him an effective tax rate of 14.1%, his campaign said Friday.

His effective tax rate was up slightly from the 13.9% rate he paid in 2010.

The majority of the candidate's income came from his investments.

His 2011 income was considerably lower than the $21 million estimated by the campaign in February.

The Romney campaign told CNNMoney that his "income can vary significantly from year to year, depending primarily on what investments are sold and how much they have appreciated or depreciated." (Related: How much should the rich pay in taxes)

The majority of the candidate's income last year came from his investments: capital gains ($6.8 million), taxable interest ($3 million) and dividends ($3.7 million).

In addition, Romney reported $450,470 in business income.

Related: Kinda rich and really rich

Romney took $4.7 million in itemized deductions and $102,790 in foreign tax credits, which likely represents taxes paid on foreign investments to other sovereign governments.

Romney and his wife, Ann, gave just over $4 million to charity, the campaign said. The amount includes more than $1 million in cash to the Church of Jesus Christ of Latter Day Saints and more than $200,000 to the Tyler Foundation, which serves families of children undergoing treatment for epilepsy. They also reported more than $900,000 in noncash contributions.

But the couple chose to deduct only $2.25 million of their charitable contributions. The reason was "to conform" to Romney's statement last month that he never paid less than 13% in income taxes over the past 10 years, Brad Malt, a lawyer who presides over the Romneys' blind trust, said in a statement.

Indeed, if the Romneys had declared the full $4 million it likely would have pushed their effective tax rate below 13%, said tax attorney Martin Press of the law firm Gunster.

"It is quite unusual for people not to take tax deductions that they're entitled to," Press said.

Tax and accounting giant PriceWaterhouse Coopers, which prepared the Romneys' taxes from 1990 through 2009, issued a letter stating they paid 100% of the federal and state income taxes owed during those 20 years.

The firm also said their average annual effective federal tax rate was 20.2% for the period. And annually, they never paid an effective rate below 13.66%.

PwC did not detail, however, how much Romney made in income during that period or how much he paid in taxes.

Related: 4,000 millionaires in Romney's '47%'

Romney has been criticized by both Democrats and even some Republicans for not releasing more than two years' worth of tax returns.

Criticism reached a crescendo when Senate Majority Leader Harry Reid repeatedly claimed, without identifying the source of his information, that Romney hadn't paid federal income taxes for a decade.

In response, Romney said he never paid less than a 13% effective tax rate in any year over the past decade. He further said the obsession over his tax returns is "small minded."

And the GOP presidential nominee has often gotten flak for having paid a low effective tax rate given his outsized income.

But contrary to popular perception, Romney's effective federal income tax rate is still higher than that of most Americans -- 80% of whom have an effective rate below 15%. That number, however, does not include other federal taxes such as the payroll tax.

Romney's running mate, Paul Ryan, released his final 2011 tax return this summer. He paid $65,000 on $323,416 in income, giving him an effective tax rate of 20%. (Related: Romney vs. Obama on tax policy)

The reason Romney's rate is so low -- despite having one of the highest incomes in the country -- is because his income was derived almost entirely from capital gains and dividends from his extensive portfolio of investments. And that form of investment income is typically taxed at just 15%, well below the 35% top tax rate for high earners.