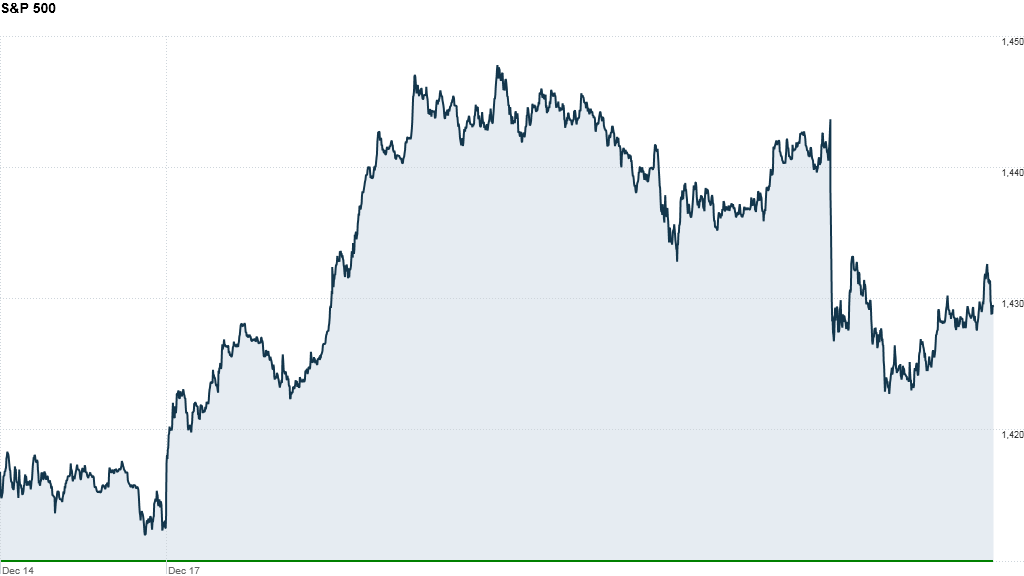

All three U.S. stock indexes finished the week higher, even after stocks dropped nearly 1% Friday on fears over the fiscal cliff.

Investors grew increasingly concerned about the latest signs of gridlock in Washington, after lawmakers in the House failed to support the so-called "Plan B", a proposal backed by House Speaker John Boehner, late Thursday.

The White House had already threatened to veto that plan, saying it would bring only "minimal" changes in projected budget deficits, but its failure underscored the lack of progress on Capitol Hill as the cliff draws nearer.

"The market has been if not priced to perfection, at least priced for a deal," said Uri Landesman, President of Platinum Partners. "Investors are selling as they see the fiscal cliff talks nearing the precipice, and it looks like Boehner can't deliver his party."

The Dow Jones Industrial Average, the S&P 500, and the Nasdaq lost between 0.9% and 1% Friday.

Fear spilled over into the oil market, as prices dropped 1.6%. Gold prices ticked up slightly.

Overall stocks are up significantly in 2012. The Dow has gained 8%, while the S&P 500 and Nasdaq are up 14% and 16% respectively.

Related: America's Debt Challenge

Investors fear that the automatic tax increases and spending cuts due January 1 in the absence of a fiscal cliff deal could tip the U.S. into recession.

With markets closing early next Monday ahead of the Christmas holiday, investors are prepared for a low volume trading week.

Adding to the drama on trading desks Friday: it was "quadruple witching day" -- when investors close out contracts on stock futures and other stock options. Market movements up or down are typically magnified on these four trading days each year.

Wall Street's key measure of volatility, the VIX, was particularly volatile Friday. The CBOE Volatility index (VIX) moved up as much as 10% but closed just 1.5% higher.

Related: Fallout from fiscal cliff inaction

On the economic front, data released by the U.S. government Friday morning showed that personal income rose 0.6% in November, while spending increased 0.4% -- both figures came in higher than expected. A report on consumer sentiment from the University of Michigan and Thomson Reuters came in lower than expected.

In company news, shares of Blackberry maker Research in Motion (RIMM) fell more than 20%, after the company reported Thursday afternoon that sales for the latest quarter fell 47%.

Nokia (NOK) announced an agreement to settle all patent claims with RIM early Friday, however, financial terms were not disclosed.

Meanwhile, Nike (NKE) shares rose 6% after the apparel giant posted quarterly earnings Thursday afternoon that beat expectations.

Shares of Walgreens (WAG) fell 3%, after the company's quarterly results showed earnings and sales dropped versus a year ago.

Casino operator Pinnacle Entertainment (PNK) announced a deal to acquire Ameristar Casinos (ASCA) for nearly $900 million. Both stocks spiked more than 20% following the announcement.

European markets closed lower on the prospect of further uncertainty about the U.S. economy, and oil prices fell. Asian markets also ended weak.

The dollar gained against the Euro but fell against the Yen. The yield on the 10-year Treasury note fell to 1.77% from 1.8% on Thursday.