Your 790 credit score might not be as great as you think it is.

For example, while a FICO score of 790 out of 850 is considered excellent, it's merely mediocre on the VantageScore model -- which tops out at 990.

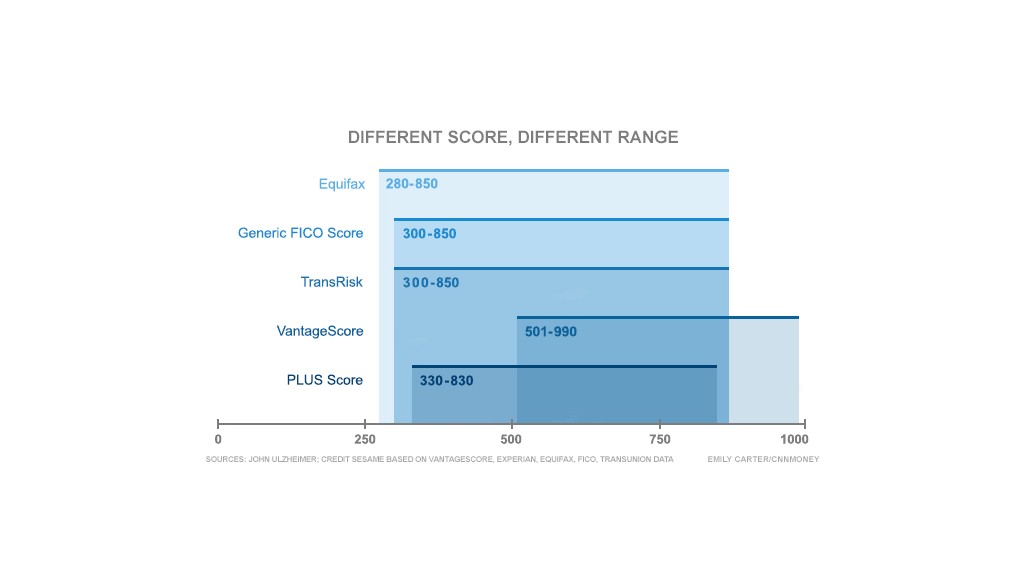

Overall, the eight most common credit scores used by lenders and consumers range from as low as 150 to as high as 990, according to a new Credit Sesame diagram created by John Ulzheimer, president of consumer education at SmartCredit.com and a former manager at FICO.

The three major credit bureaus, TransUnion, Experian and Equifax each have their own scores. TransUnion's TransRisk score ranges from 300 to 850 and the Equifax Credit Score ranges from 280 to 850. Meanwhile, one Experian score ranges from 360 to 840 and another ranges from 330 to 830. And then there's the score the bureaus created together, the VantageScore, which ranges from 501 to 990.

All of these different scoring models can make it hard to know how you're actually being assessed by a lender. While most lenders look at a FICO score to gauge an applicant's risk, consumers typically attain non-FICO scores from consumer websites and credit reporting agencies, said Ulzheimer.

Related: Your credit score isn't what you think it is

"We've been raised with an A through F, 0 to 100 system for everything, and now we have all these weird ranges that don't make a lot of sense, so it can be confusing," said Ulzheimer. "I have people calling me, saying 'I have a fantastic score of 800, and then I find out it's a VantageScore and all of a sudden it's not so good.'"

Other consumers see a score of 900 and think it must be wrong since they know the FICO score maxes out at 850. What they don't realize is that they received the higher-ranging VantageScore instead, he said.

Related: You have 49 FICO credit scores

Aside from the VantageScore, most scoring models don't veer too far from FICO's 300 to 850 range, so it's generally safe to assume that a non-FICO score will at least be in the same ballpark, said Ulzheimer. "But if they get a VantageScore and assume it's the same as their FICO score, then they'll be disappointed when they apply with a lender," he said.

All scores are based solely on information in credit reports and consider payment history, balances relative to credit limits, credit inquiries and the length of credit.

To get a sense of where you stand relative to other credit applicants, look at where you fall in terms of national percentile, said Ulzheimer. To qualify for the best credit terms, you typically need to fall in at least the 50th percentile, which translates to a FICO score of 720 or higher. While lenders don't use peer ranking to make decisions, this information is often provided to consumers with their scores.

Adding to the confusion, lenders aren't always looking at the same scores either. Within the FICO category alone, lenders look at more than 49 different FICO scores to assess risk -- but consumers generally only receive the generic FICO score. And one out of five consumers is likely to receive a score that is "meaningfully" different from the score used by a lender to make a credit decision, a recent study from the Consumer Financial Protection Bureau found.