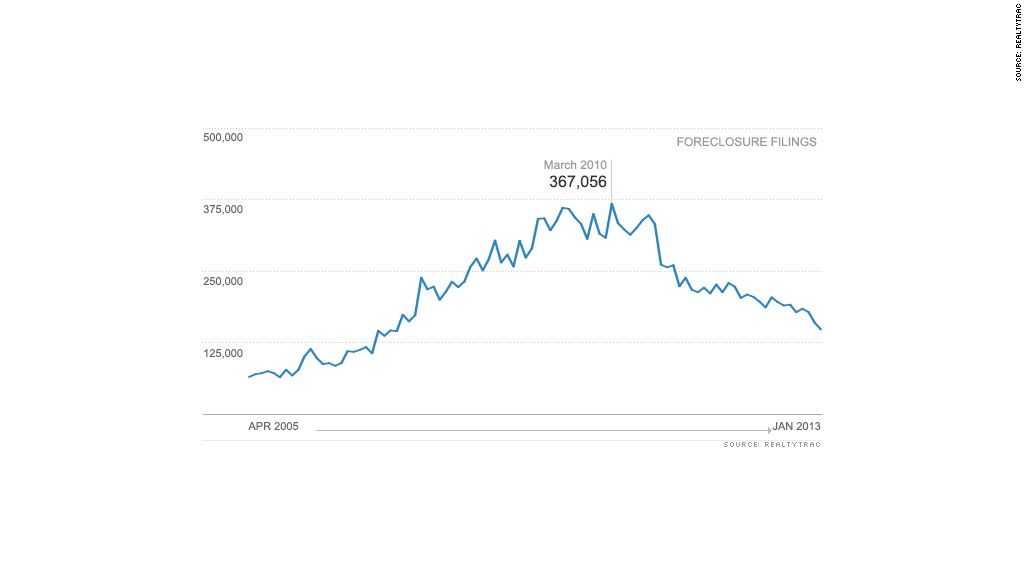

Foreclosure filings in January plunged to their lowest level since April 2007.

Notices of default, scheduled auctions, bank repossessions and other filings fell to 150,864 last month, a 7% decline from the previous month and a 28% drop from January 2012, according to RealtyTrac. New foreclosure filings fell to the lowest level since June 2006.

"We're now well past the peak of the foreclosure crisis," said Daren Blomquist, spokesman for RealtyTrac.

Regulations that took effect in California contributed to the dramatic decline. The state had long been recording the highest number of foreclosure filings of any state. But on January 1, a Homeowner Bill of Rights became law, offering more protections for California borrowers in default. As a result, new foreclosure filings in California fell 62% in January.

Under the new rules, mortgage servicers must halt all foreclosure proceedings once a borrower applies for a mortgage modification. Servicers will also face fines of up to $7,500 per loan if they record and file multiple unverified documents in foreclosure proceedings.

Related: 10 great foreclosure deals

"There's was a bum's rush to get people out of their homes before this law came into effect," said Bill Purdy, a real estate attorney in Soquel, Calif. Once 2013 began, filings in California dropped abruptly, down 40% from December and 65% from January 2012.

Last month marked the first time since January, 2007 that California did not lead the country in foreclosure filings. Instead, Florida took the top spot, with 29,800 filings -- or one out of every 300 homes -- followed by Nevada and Illinois.

The nation's foreclosure problem isn't fixed -- but we're getting closer, according to Blomquist. Filings are still running at about twice the pace of 2005, before the subprime mortgage crisis derailed the housing market. And foreclosure auctions rose in 26 states, including four big ones: Florida, Illinois, Pennsylvania and New Jersey.

Related: Million dollar foreclosures for sale

But bank repossessions, the end game for borrowers when they actually lose their homes, fell to less than half the record 102,134 set in September, 2010. Blomquist is forecasting steady improvement through 2013.

"It's likely that by this time next year, we'll start to see 2005-type, pre-crisis numbers again," he said.