The mortgage interest deduction is one of the most expensive tax breaks on the books, but its benefits are distributed unevenly across the country, according to a new report by the Pew Charitable Trusts.

In 2010, the year that Pew analyzed, the mortgage deduction resulted in $80 billion of forgone revenue to the federal government. Over five years, the tax break is expected to reduce revenue by about $380 billion.

The deduction is claimed by fewer than a third of federal tax filers and less than half of homeowners. Only those with mortgages who itemize their deductions, rather than claim the standard deduction, can benefit from it.

As Congress starts to pursue tax reform, who benefits from the deduction and how it affects different states will be a factor in any discussion about changing it.

"[F]ederal taxes could increase in some areas and decrease in others. These results could, in turn, affect economic activity both across and within states," the Pew report noted.

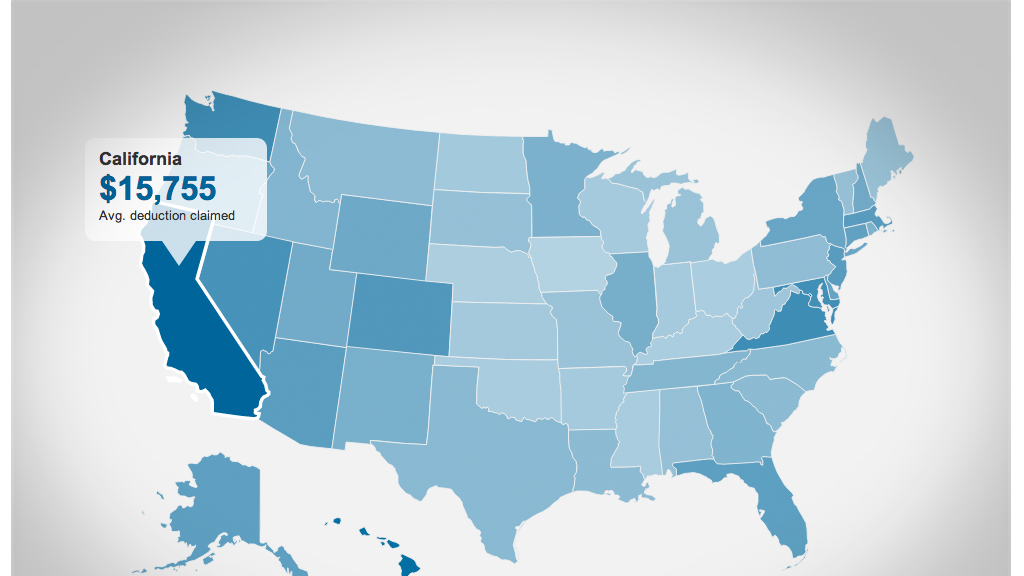

Generally speaking, Pew found that states on parts of the East and West Coasts had the highest number of people filing for the mortgage deduction and also claiming the highest average amounts compared with states in the South and Midwest.

Minnesota is an exception: It had a high percentage of filers using the deduction and claiming relatively high average amounts.

Within states, filers in large metropolitan areas were most likely to claim the deduction and to claim higher amounts.

More specifically, Pew found that California took the No. 1 spot in a few categories: It had the most tax filers in the country (16.7 million). It also had the highest number of mortgage deduction claims (4.6 million). And in aggregate the state claimed the highest number of mortgage deduction dollars (nearly $72 billion).

Related: Homebuyers clueless about mortgages

But when it came to averages claimed among filers, California actually took a backseat to Maryland. Among all federal filers in California, the average mortgage deduction claimed was $4,311, whereas among all Maryland filers it was $4,580, or more than 1.5 times the U.S. average of $2,713.

When calculated just among filers who actually claimed the mortgage deduction, however, California retains its top-dog position. Its average deduction was $15,755, which is about 50% higher than the U.S. average of $10,640 and more than double the lowest average, $7,177 in Iowa.

North Dakota had both the lowest number of claims (50,000), and the lowest average deduction of $1,192 across all filers. Other states with relatively low numbers of claims and low averages include West Virginia, Mississippi, Louisiana, Arkansas and South Dakota.

Related: See how your mortgage deduction compares

No one has seriously proposed getting rid of the mortgage deduction altogether. It's very popular and eliminating it entirely might disrupt the housing market.

But if lawmakers choose to reform the mortgage break, many experts say it should be rejiggered so it does a better job of promoting homeownership, while not disproportionately benefiting high-income households anymore.

"The mortgage interest deduction should be restructured, with more of the subsidy directed to low- and middle-income taxpayers who are more likely to be deciding whether to own or rent," Eric Toder, a co-director of the nonpartisan Tax Policy Center, said at a hearing of the House Ways and Means Committee last month.

One proposal would convert the deduction to a credit equal to a percentage of interest one pays, and capping how much interest is eligible. For example, a taxpayer could take a credit for 15% on no more than $25,000 in interest.

That would broaden the reach of the break, since all homeowners with a mortgage could claim it, regardless of whether they itemize.

And it would no longer skew the benefit in favor of higher-income homeowners.

Here's why?

Currently, the deduction reduces tax liability by a percentage equal to one's top tax rate. In other words, the higher your income, the higher your top rate, and the bigger your deduction.

By contrast, a tax credit is a dollar-for-dollar reduction of the taxes your owe. And capping it at a given level -- say 15% of mortgage interest paid -- means everyone gets the same break regardless of income.

Other ideas include further limiting the size of the loan eligible for the interest tax break, and allowing the break only for loans on principal residences. Right now, homeowners may deduct interest on second homes as well as principal residences so long as the combined amount borrowed doesn't exceed $1 million, and they may deduct interest on home equity loans up to $100,000.