There are more than 200 tax breaks in the U.S. tax code, and the top 10 for individuals are by far the most expensive. How expensive? They will cost federal coffers $12 trillion over the next decade.

But the dollar benefits of those top 10 breaks are not distributed evenly across income groups.

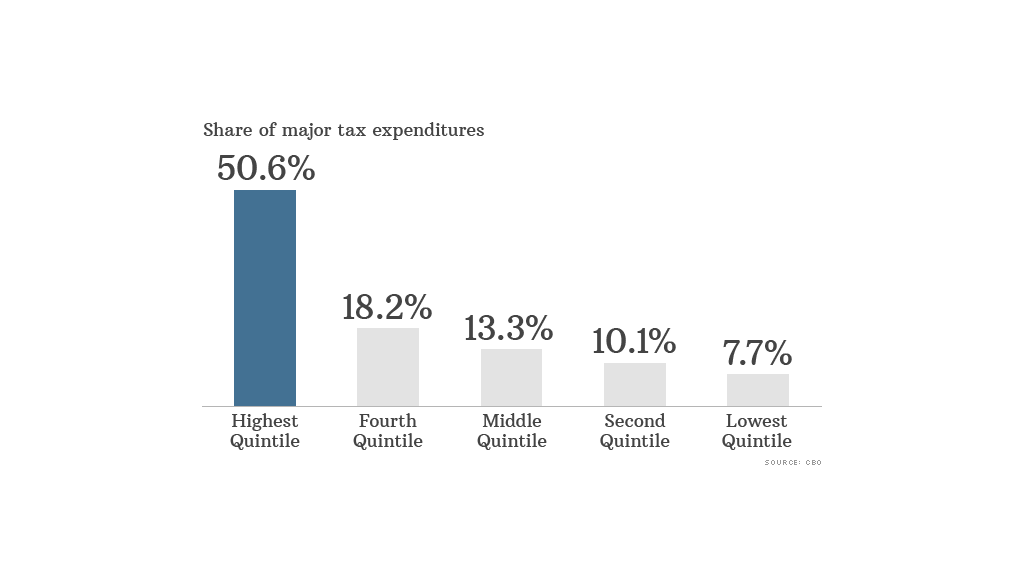

The top 20% of households will enjoy more than half of the combined benefits of the major tax expenditures this year, according to a report by the Congressional Budget Office released Wednesday.

And within that top 20%, the benefits skew disproportionately to the highest earners.

The top 1% -- who make at least $327,000 as individuals or $654,000 as a family of four -- get 17% of the breaks' value.

The largest breaks include the tax-free treatment of employer contributions to workers' health insurance; tax preferred retirement savings; state and local tax deductions; and reduced rates on capital gains and dividends.

Related: Worst corporate tax breaks

That's not to say that low- and middle-income households don't benefit from the major tax breaks and wouldn't notice if they were curtailed -- a distinct possibility when lawmakers eventually do embark on tax reform.

This year, households in the middle income quintile will enjoy about 13% of the value of the biggest breaks, the budget office estimates. Those in the middle include one-person households earning roughly $39,000 to $55,000 and four-person households earning between $77,000 and $110,000.

The lowest earners, who make no more than $25,000 as singles or $50,000 as four-person households, will get only 8% of the benefit of the tax expenditures. What value they do see will come primarily from the Earned Income Tax Credit and, to a lesser extent, the child tax credit.

Looking ahead, the CBO notes that once health reform is in full swing starting next year, lower- and middle-income families will start to qualify for the federal tax subsidies to buy health insurance on newly created insurance exchanges.

"Those credits are expected to be substantial," the CBO wrote. At the same time, it also noted that "because many of the lowest-income taxpayers will be eligible for Medicaid, they will not benefit from the tax expenditure."