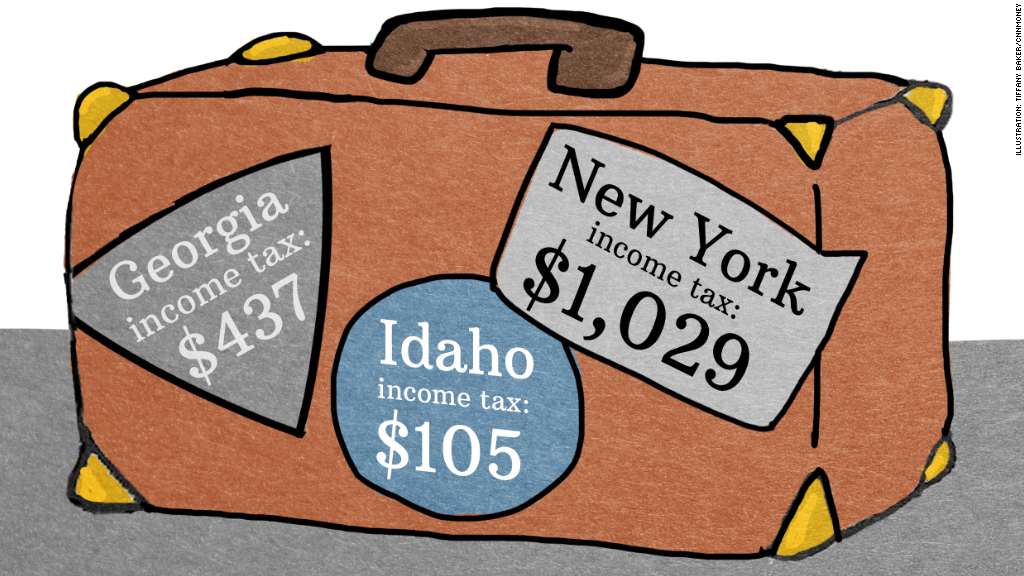

Ever travel to New York for work, even for a day? How about to any other state?

Whenever you do, you're entering into another universe that may require you to pay tax on the income you earn while you're there.

But many business travelers and their employers aren't abiding by the rules, whether they realize it or not.

And it's easy to understand why.

Fifty states mean 50 different sets of rules.

In some states, you may be obligated to file a tax return even if you just spent a few hours there all year. Other states set minimum thresholds, based on the days you're there or how much you make during your trip.

And nine states don't impose any income tax at all. So no fear they'll hassle you.

Meanwhile, the rules for when your employer must start withholding tax from your paycheck on behalf of the state you travel to are also all over the map.

Indeed, in some states withholding rules don't square with the filing rules for the business traveler.

Quiz: Which state has the highest income tax rate?

New York, for instance, requires that anyone who comes for business must file a nonresident return for income earned from day one. But those travelers' employers are only required to start withholding New York tax if they work in the state for at least 14 days.

Who follows the rules? Several sources told CNNMoney that there is "rampant noncompliance."

Still, the rules are "not universally ignored," said Verenda Smith, deputy director of the Federation of Tax Administrators.

Those most likely to comply are professional athletes, entertainers and big-firm lawyers and accountants.

Take Jamie Yesnowitz, a principal at tax advisory firm Grant Thornton. He gives speeches around the country about state and local taxation. In 2011, he found himself filing 11 state tax returns.

"My wife looked at me like I had two heads," Yesnowitz said.

Related: Perils of moving to no-tax states

But other types of road warriors can find themselves in a similar situation if their employer is audited or simply withholds taxes where required -- a process that, by the way, can be very costly for the company.

Vincent Cervone, a CPA in Brooklyn, said one client -- a salesman for a large company -- had to file 10 different state tax returns in addition to his home state return.

If you do end up owing tax to another state, you're allowed to take a credit for that money on your own state's return. But that still might not make you whole because of differences between state tax systems. Not to mention the extra you have to pay your tax preparer.

Companies, payroll associations and tax professionals have been calling for greater uniformity among states when it comes to business travel.

Without it, "it's a compliance nightmare," said Cara Griffith, editor-in-chief of state tax publications for Tax Analysts.

There's a bill in Congress called the Mobile Workforce Simplification Act, which would exempt most business travelers from income tax in any state not their own unless they work there at least 30 days a year. And employers wouldn't have to withhold taxes before that threshold is met.

The bill has been revised several times, primarily to accommodate New York's concerns, said Maureen Riehl, a spokesperson for the Council on State Taxation, a trade association for companies that do business across states.

But the accommodations so far still haven't brought New York on board, she said.

Related: Smart business travel tips

New York is among the most aggressive states in terms of tax collection and stands to lose the most revenue if the Mobile Workforce bill became law, multiple sources noted.

The New York State Department of Taxation and Finance did not comment for this story.

Figures on how often people get in trouble are hard to come by. States that have gone after companies, to date, have likely focused on travel by high-paid executives, Griffith said.

But going forward, states may get more active, particularly after the hit their coffers took during the recession.

"This is one area they weren't heavily auditing in the past," Griffith said. "So there's potential for revenue."