Mortgage interest rates fell after the Federal Reserve said last week that it won't pare back its stimulus program.

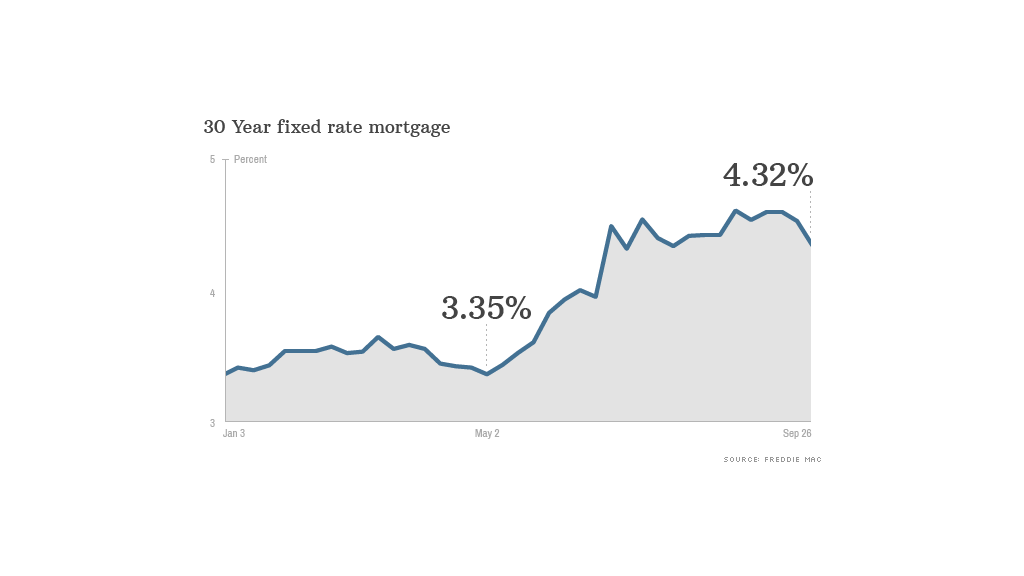

The rate for a 30-year, fixed loan fell to 4.32% from 4.5%, according to a weekly survey from Freddie Mac.

While that represents only a small savings for borrowers - $21 a month on a $200,000 balance - it's still good news for the housing market. Mortgage rates have been moving higher in the last few months, which analysts feared could put the brakes on the real estate recovery.

Related: CNNMoney's mortgage loan calculator

"Mortgage rates fell following the Federal Reserve announcement that it will maintain its bond-buying stimulus," said Frank Nothaft, Freddie's chief economist. "These low rates should help offset the house price gains seen in the last number of months and keep housing affordable."

Interest rates had gone as low as 3.35% in early May and, following the Fed's hints that it would begin to taper its bond purchases, rose more than a percentage point by late June before leveling off.

Related: Are we headed toward 5% mortgages?

"After hearing about rising mortgage rates for months, consumers should welcome the news of a decline," said Keith Gumbinger, of HSH.com, a mortgage information firm. "The Federal Reserve's decision to keep its quantitative easing programs running for at least a while longer allowed mortgage and bond markets a chance to relax, at least for a little while."

But many analysts expect the Fed to start to taper later this year, which should push mortgage rates higher.