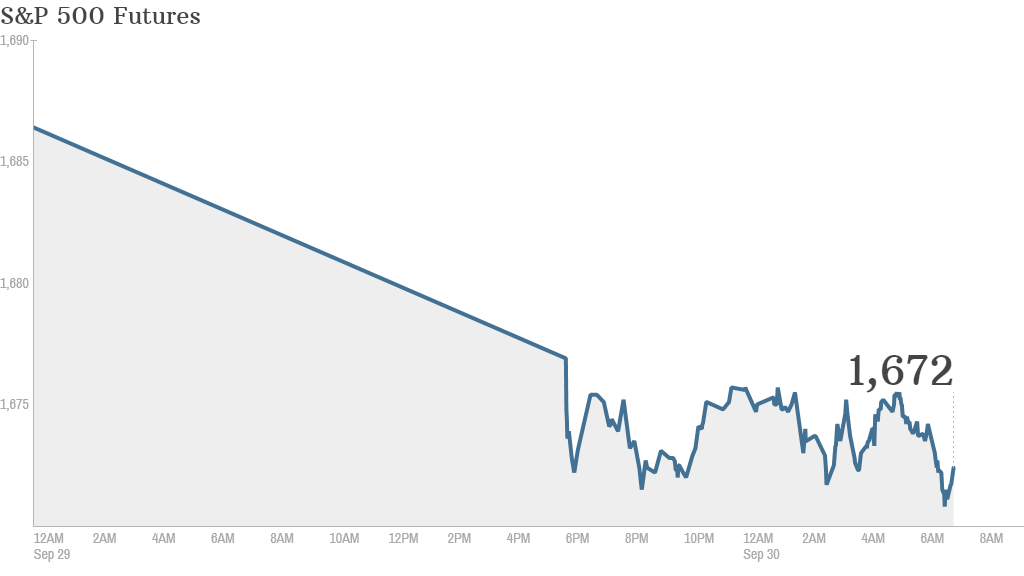

Stock markets are set for a sell-off Monday as political squabbling in Washington threatens to lead to a government shutdown at midnight.

U.S. stock futures were all down by roughly 0.8% as investors lose faith in their political leaders and worry about the effect that a shutdown could have on the U.S. economy.

"If nothing is agreed by tonight, which seems likely, there will be an economic hit as some [government] employees are put on unpaid leave and non-essential government services close," explained economist Robert Wood from Berenberg Bank.

Related: 8 things you need to know about the debt ceiling

Monday is the last day of the month and the third quarter. Both the Dow Jones industrial average and the S&P 500 index have risen by well over 3% so far in September, hitting record highs as investors cheered continued stimulus by the U.S. Federal Reserve. All three indexes are up for the quarter, led by the Nasdaq, which has risen 11%.

But markets have pulled back as the shutdown looms and the U.S. nears its debt ceiling, a limit on the amount it can borrow. If the government hits its debt ceiling in mid-October, it will not be able to pay its bills and will default, though many people believe a last-minute solution will be found.

Related: Fear & Greed Index, sliding into fear

U.S. stocks fell Friday. The Dow and S&P finished the week with a 1% loss, though the Nasdaq eked out a gain.

European markets were all falling in midday trading, with renewed political turmoil in Italy further undermining sentiment. Of the major indexes, the CAC 40 in Paris was deepest in the red, declining by 1.3%.

Italian markets took a hit after Silvio Berlusconi pulled his support for the country's coalition government over the weekend, threatening early elections. The main Italian stock index fell by over 1.5% and yields on 10-year government bonds edged higher.

Related: How the government will shut down

"Berlusconi has thrown Italian politics into potential chaos again after ordering his five ministers to resign from the coalition," wrote Deutsche Bank analyst Jim Reid, in a market report. "It's an impressive feat to knock off a potential U.S. government shutdown from top billing but Berlusconi might have achieved it."

Asian markets closed with losses, though the Shanghai Composite index bucked the trend and moved higher. China launched a free trade zone in the city on Sunday, an experiment in promoting trade, expanding foreign investment access and liberalizing the financial sector.