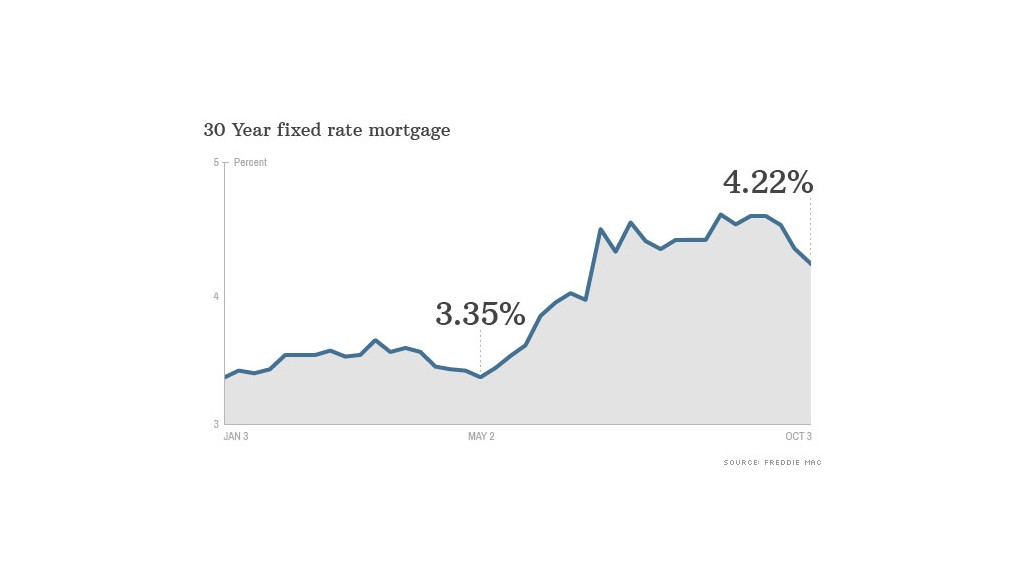

Mortgages got more affordable again this week.

The average interest rate for the most popular kind of home loan, the 30-year fixed rate, fell to 4.22%, down from 4.32% a week earlier.

Rates, as measured by a weekly Freddie Mac survey, have dropped from 4.57% since the Federal Reserve unexpectedly announced three weeks ago that it would not alter its stimulus program of buying Treasury bonds and mortgage-backed securities.

Most industry experts had thought the Fed would start to taper off those purchases, which bring liquidity to the mortgage markets and help keep rates low.

Related: Top 10 markets to buy an investor property

The rate decline can also be traced to economic uncertainty, which has heightened due to the government shutdown, according to Frank Nothaft, Freddie's chief economist.

"With the onset of the federal government shutdown and declining consumer confidence, fixed mortgage rates fell for the third consecutive week," he said.

For borrowers applying for $200,000 loans, the rate decline over the past three weeks could save them about $42 a month, $500 a year -- if they can get a mortgage.

Calculate what your mortgage payment would be

"While this is great news for mortgage shoppers, what's not great is that it comes as the government has ground to a halt, making it hard for mortgage lenders to get verification of tax returns or even Social Security numbers," said Keith Gumbinger, vice president of HSH.com, a mortgage information firm. "This is likely to slow the loan approval process."