Investors remain cautious heading into the last trading day of a tumultuous week.

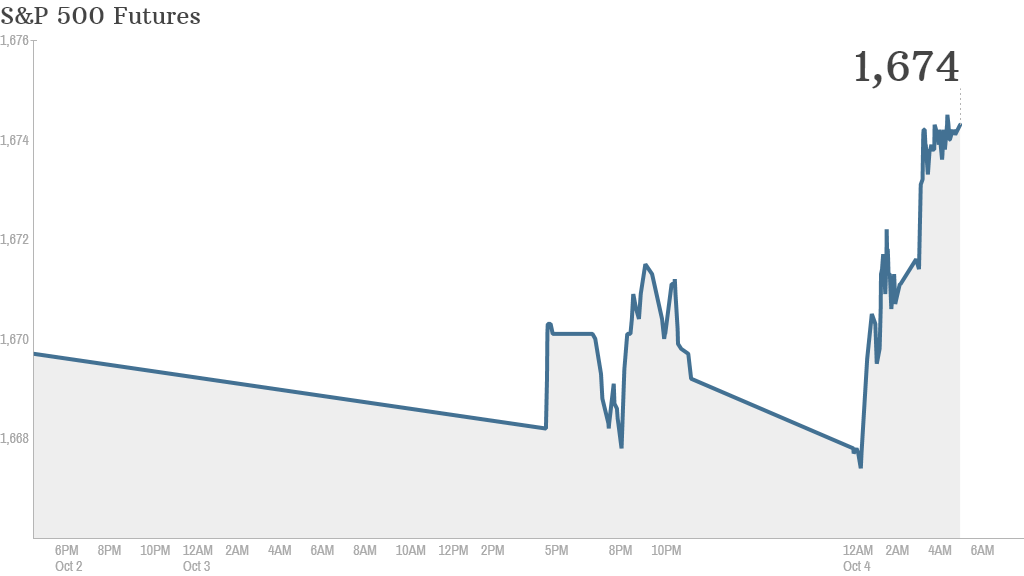

U.S. stock futures edged slightly higher early Friday morning.

Now in its fourth day, the U.S. government shutdown has created plenty of uncertainty and left an estimated 800,000 federal employees off the job.

The government's monthly jobs report, originally scheduled to come out Friday morning, will not be released due to the shutdown. Since the recession, the report has become the most closely watched indicator on the economy.

Related: Fear & Greed Index, still consumed by fear

Investors also continue to worry about the U.S. hitting its debt ceiling. Failure to raise the debt limit is likely to have a significant impact on the global economy, as well as stocks, bonds and currency markets.

U.S. stocks fell sharply Thursday. The Dow Jones Industrial Average and the S&P 500 have dropped for nine of the past 11 trading days.

Related: Debt fight could spark a recession

European markets edged higher in morning trading, led by the CAC 40 in Paris. Switzerland's financial watchdog, the Swiss Financial Market Supervisory Authority, announced that it was investigating several Swiss banks for possibly manipulating currency exchange rates.

The major Asian markets ended with losses. The Nikkei in Japan shed nearly 1% after the Bank of Japan wrapped up its two-day monetary policy meeting and opted to maintain its stimulus measures. South Korean electronics manufacturer Samsung said it was on track for another record quarterly profit.

The Shanghai Stock Exchange was closed for the National Day celebration.