Company earnings and economic data will take center stage Monday after U.S. stocks come off a week that saw the S&P 500 set a record high.

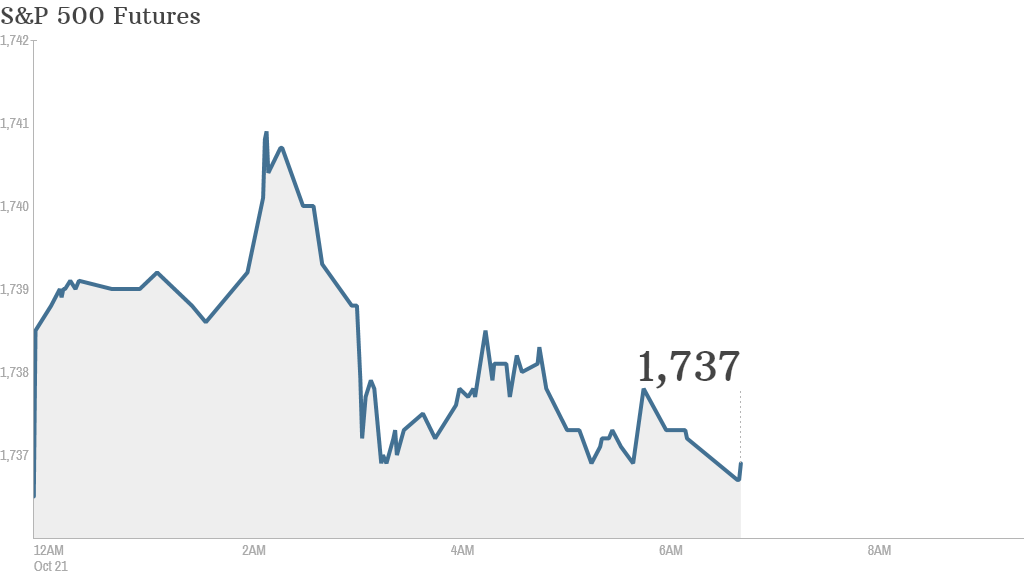

U.S. stock futures were little changed.

The wave of third-quarter earnings results continues Monday with results due in the morning from McDonald's (MCD) and Halliburton (HAL). Netflix (NFLX) is due after the closing bell.

Related: Fear & Greed Index, back to greed

At 10 a.m. ET, the National Association of Realtors will release its monthly report on existing home sales.

Stocks finished higher Friday, continuing a rally in the aftermath of the end of U.S. government debt and budget crisis. The S&P 500 hit a record high. The Nasdaq posted a gain of more than 1% on Friday and was up more than 3% for the week. The Dow Jones industrial average was up more than 1% for the week, and has advanced for two consecutive weeks.

Peter Cardillo, chief economist at Rockwell Global Capital, said the rally "seems to have long legs," driven by decent earnings reports. But he added that "the market will be looking for an excuse" to pull back by 1% or 2%. That excuse, he said, might be the monthly jobs report, which was postponed for Tuesday from Oct. 4, as a result of the partial shutdown of the federal government.

Related: Nothing holding the market back

Bank stocks will be in focus after weekend news that JPMorgan Chase (JPM) and the Department of Justice have tentatively agreed to a $13 billion civil settlement to resolve several investigations into the bank's mortgage securities business.

European markets were mixed in midday trading. Indexes in Germany and France slipped, while the FTSE 100 managed a modest gain.

Asian markets closed higher Monday. Shares in Hong Kong added 0.4% and the Shanghai Composite increased 1.6%. Japan's Nikkei gained 0.9% and the yen weakened as export data for September fell short of analyst expectations.