Stocks continue to run in record territory, and with just another little leg up, the three major indexes could surpass some big milestones.

The Dow Jones industrial average is closing in on 16,000, while the S&P 500 is inching toward 1,800, both of which would be reached for the first time. The tech-heavy Nasdaq is nearing 4,000, a level not seen since September 2000, just months before the collapse of the dotcom bubble. All three indexes are within 1% of the psychologically important mileposts.

Investors are likely still in a good mood Friday, a day after Federal Reserve chair nominee Janet Yellen told a Senate panel that she is determined to support the U.S. economic recovery, and believes the Fed's bond-buying program still has the power to help.

The central bank's $85-billion-per-month bond-buying program -- also known as quantitative easing or 'QE' -- has helped spur stocks by pumping markets with extra cash.

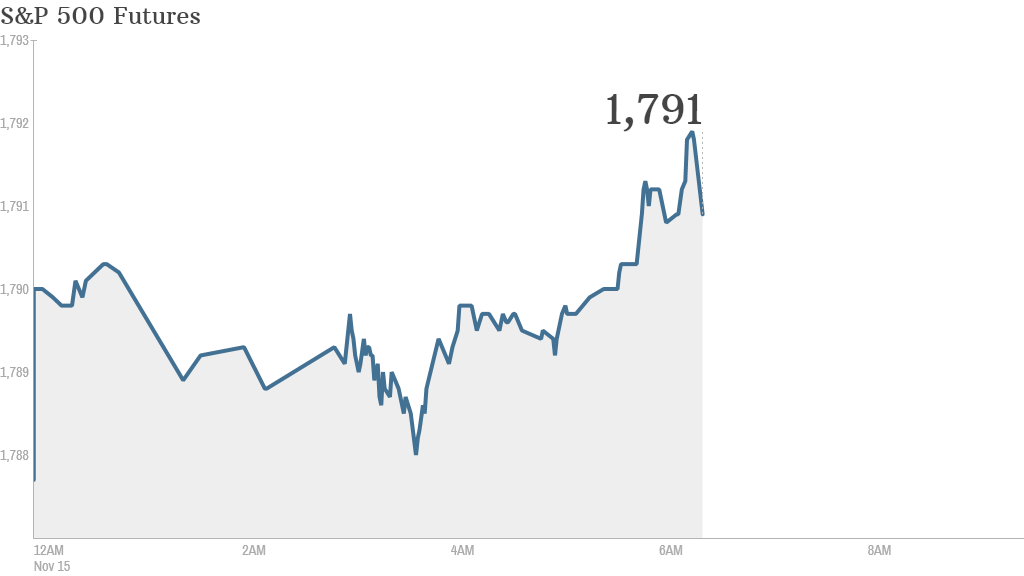

U.S. stock futures inched higher ahead of the open, after finishing a fresh record highs Thursday.

Shares in Exxon Mobil (XOM) were higher in premarket trading after it was revealed that Warren Buffett's Berkshire Hathaway (BRKA) made a big bet on the company, buying roughly 40 million Exxon shares -- worth $3.74 billion at Thursday's closing price.

Credit rating agency Moody's downgraded four of the biggest U.S. banks, saying that it was now less likely the federal government would bail them out in the case of a crisis. Shares of the four - JPMorgan Chase (JPM), Goldman Sachs (GS), Morgan Stanley (MS) and Bank of New York Mellon (BK) -- were not yet trading early Friday. Moody's reaffirmed its ratings on four other major banks -- Bank of America (BAC), Citgroup (C), State Street (STT) and Wells Fargo (WFC), and their shares were either little changed or not yet trading.

European markets were mixed in midday trading, with London's FTSE 100 index edging higher while the main indexes in France and Germany moved slightly lower.

All the main Asian markets ended with solid gains. The main indexes in Tokyo, Hong Kong and Shanghai all pushed up by nearly 2%, in part bolstered by the dovish talk from Yellen.