Investors were showing signs of caution Tuesday morning, a day after the Dow and S&P 500 hit record peaks.

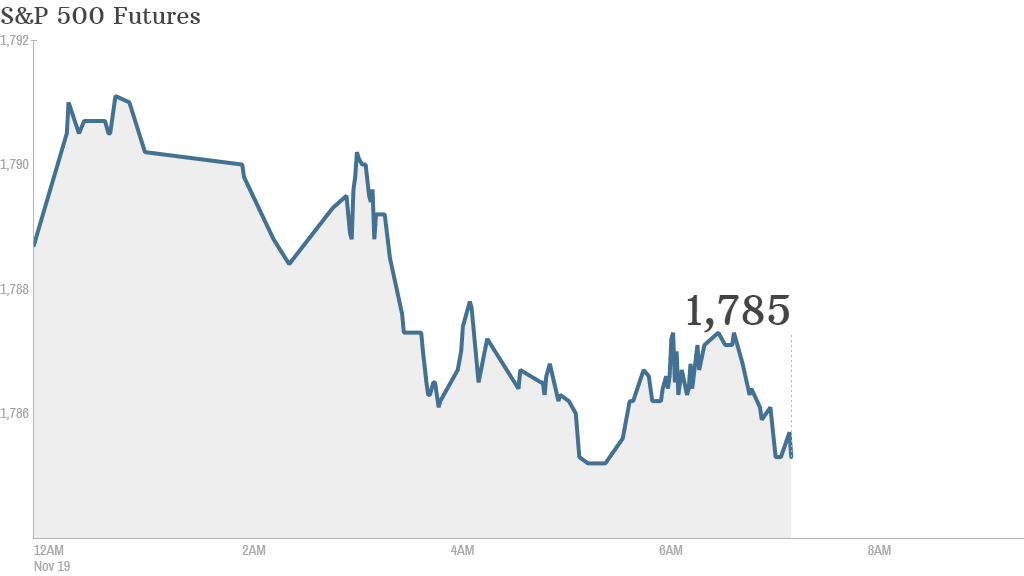

U.S. stock futures edged lower ahead of the opening bell.

"We're reaching some big psychological levels on all three of the major indices," said Alastair McCaig, market analyst at IG in London. "Nobody really wants to be buying right at the top."

Investors were awaiting a number of corporate announcements, which could help set market direction.

JPMorgan Chase (JPM) and the Justice Department are expected to finalize a $13 billion settlement related to the bank's past mortgage practices. The settlement and announcement could come as soon as Tuesday.

Shares of Nokia (NOK) and Microsoft (MSFT) could also move depending on the outcome of a vote over Microsoft's planned acquisition of Nokia's mobile phone business. The sale is widely expected to be approved by shareholders.

On the earnings front, Best Buy (BBY) reported quarterly revenue and profit that beat expectations. But shares took a dive in premarket trading after the electronics retailer said that "more promotions in Q4 could hurt gross margin."

Urban Outfitters (URBN) shares slipped after the retailer offered cautious guidance for the fourth quarter.

Campbell Soup (CPB) lowered its guidance after a weak quarterly report. Chief Executive Denise Morrison said she was "disappointed."

Home Depot (HD)reported significant growth in profit, revenue and same-store sales, and raised guidance for the year.

Tesla (TSLA) shares plunged after the National Highway Safety administration opened an investigation into vehicle fires.

Related: Fear & Greed Index, still greedy

U.S. stocks finished mixed Monday. The Dow Jones industrial average topped 16,000 for the first time while the S&P 500 briefly surpassed 1,800. But neither index closed above those milestones.

Related: 8 things to know about the 2013 bull market

European markets were dipping in morning trading, with the CAC 40 in Paris declining by roughly 1%.

Asian markets ended with mixed results. The main Chinese indexes in Shanghai and Hong Kong pulled back a tad after a big run-up Monday. Chinese stocks had been rallying strongly based on a number of reforms announced by Beijing.