If you're a U.S. investor, it's the most wonderful time of the year. Not only are the holidays nearly here, but markets are close to all-time highs.

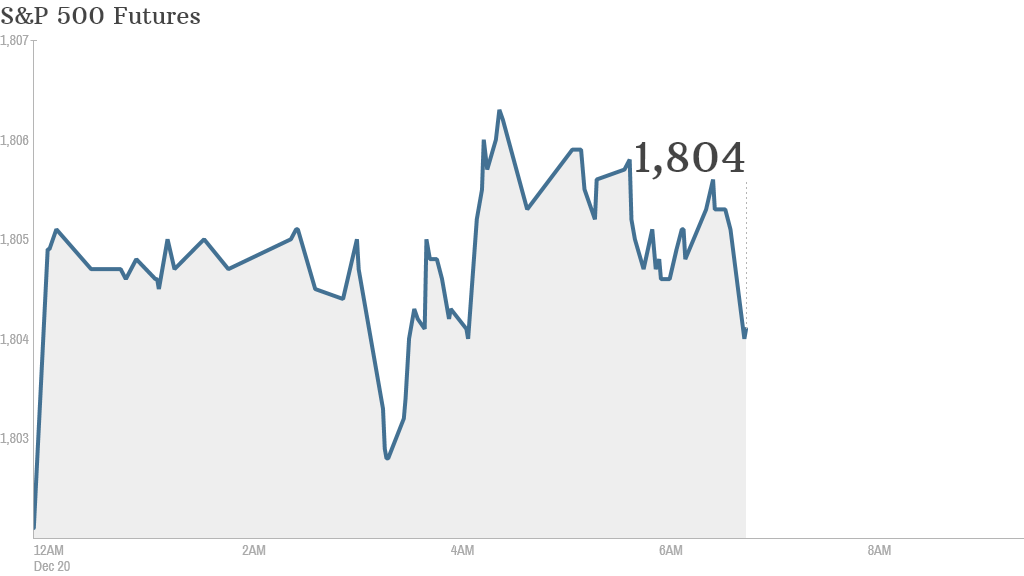

And there could be more cheer Friday morning, with U.S. stock futures indicating modestly positive start when the bell rings.

December is often a good month for stocks -- a trend that has been dubbed the Santa Claus rally.

Related: Fear & Greed Index stalls into neutral

But all is not well in China, where cash crunch concerns are troubling investors.

China's benchmark index, the Shanghai Composite, fell for a ninth consecutive day Friday, dropping 2% to a four-month low even after an emergency cash injection by the country's central bank.

The People's Bank of China made the announcement on Weibo -- a micro-blog site similar to Twitter (TWTR) -- but the move largely failed to quell investor fears that cash was in short supply in the system, in an echo of a liquidity crunch earlier in the year.

The Shanghai Composite has fallen by just over 6% this month and is down by 8% since the start of the year.

Gold extended its decline Friday, a day after dropping to a three-year low. Prices have dropped 30% this year, the worst annual performance for the precious metal in decades.

Related: Federal Reserve assets now top $4 trillion

Looking ahead to Friday, the U.S. government will release its third estimate of third-quarter GDP at 8:30 a.m. ET Friday.

In corporate news, BlackBerry (BBRY) reported a steeper-than-expected $4.4 billion loss and a 56% drop in quarterly sales. The struggling smartphone maker also announced a five-year strategic partnership with Taiwanese electronics contract manufacturer Foxconn.

Drugstore chain Walgreen (WAG) reported quarterly gains in sales and net income.

U.S. stocks finished flat Thursday, though the Dow Jones Industrial Average managed to eke out a new high ... its 46th record close of the year.

Related: Google fined $1.2 million over privacy violations

European markets were mostly higher in morning trading, while Asian markets ended mixed. The Hang Seng in Hong Kong drifted lower, but other markets posted big gains to end the week.

Australia's ASX All Ordinaries rose 3.2%. India's Sensex was up by 1.5%.