Christmas may be over, but it seems Santa is still delivering good news for investors.

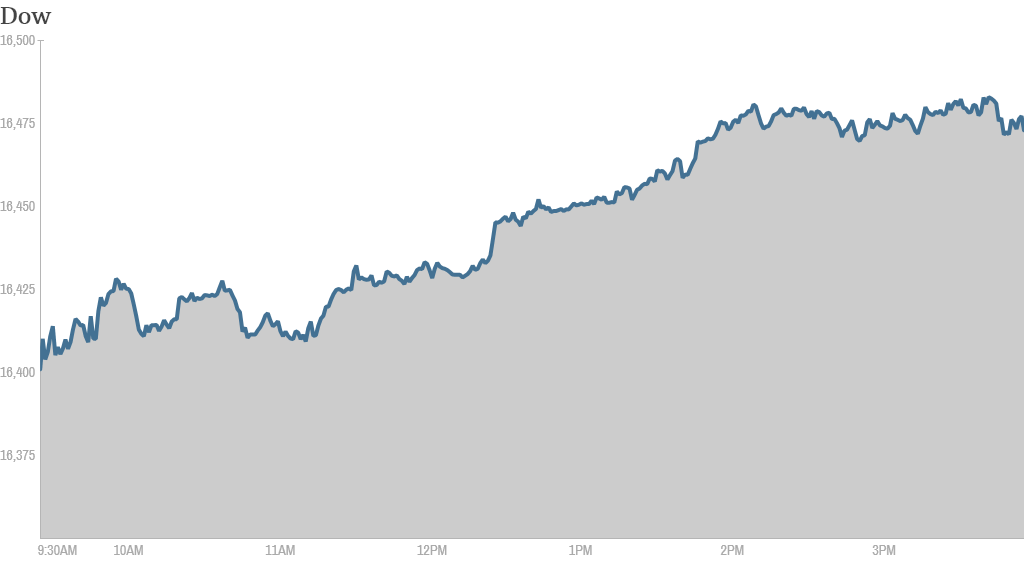

The Dow Jones industrial average closed at a record high for the 50th time this year. The S&P 500 also ended at a record high and the Nasdaq marked a new 13-year high.

U.S. markets were closed Wednesday for the Christmas holiday break. Trading volume has been below average, with many professional money managers taking the week off or working remotely.

Still, the week is turning out to be a good one for stocks, with not much bad news to stop investors from taking the market on an incredible year-end rally.

Over the past 100 years, the Dow has gained during the week of Christmas 68% of the time, according to Schaeffer's Investment Research.

Related: Fear & Greed Index gets greedy again

Markets have charted big gains this year. The Dow and S&P 500 are both up more than 20%, while the Nasdaq has soared over 30%.

The broad rally puts the Dow on track for its best year since 2003 and the S&P 500 on pace for its best year since 1997.

This year's gains have been driven by ongoing economic stimulus from the Federal Reserve, increased confidence in the economy, solid corporate earnings growth and more individual investors entering the stock market.

Related: China's $50 billion move to avert cash crunch

The Fed announced earlier this month that it will modestly reduce its bond buying program in January. But many experts believe the bull market, which began in early 2009, will continue for a sixth year in 2014, albeit at a more modest pace.

Meanwhile, the bond market continues to retreat. The yield on the 10-year Treasury note briefly traded at 3% on Thursday, matching the highest level of the year.

On the economic front, initial claims for unemployment benefits fell last week, according to government data released Thursday.

Shares of UPS (UPS) and FedEx (FDX) were little changed despite delays that caused both package delivery companies to miss holiday deadlines. Amazon (AMZN) offered a $20 gift card and also a refund of shipping charges for customers who did not receive their packages on time.

The problems with UPS come weeks after Amazon founder Jeff Bezos unveiled plans to use unmanned aerial vehicles -- or drones -- to deliver small packages in four to five years.

"$AMZN bring on the drones move over $UPS," said StockTwits user tferraro5.

While the delays were a public relations headache for UPS, some traders see a sliver lining.

"$UPS is so busy they can't even get all their packages delivered? Sounds like profit to me," said Acropolis.

Twitter (TWTR) continued a spectacular rally. Shares of the social media company rose 5%. The stock has gained more than 76% in December and has more than doubled in price since its November IPO.

Some traders said the run is being driven by large institutional investors and that once they stop buying, Twitter shares will crash.

"$TWTR This is going to fall. HARD. And those left holding after the big boys leave will be sorry..." said mo_karney.

Others were predicting even more gains for Twitter, which is currently trading at just under $74 a share.

"$TWTR blue bird wants to see $80 before 2014," said tecrider.

Many European and Asian markets were closed for Boxing Day. The Nikkei gained 1%. Japan's stock exchange is up 51% for the year, making it the best performing global benchmark.