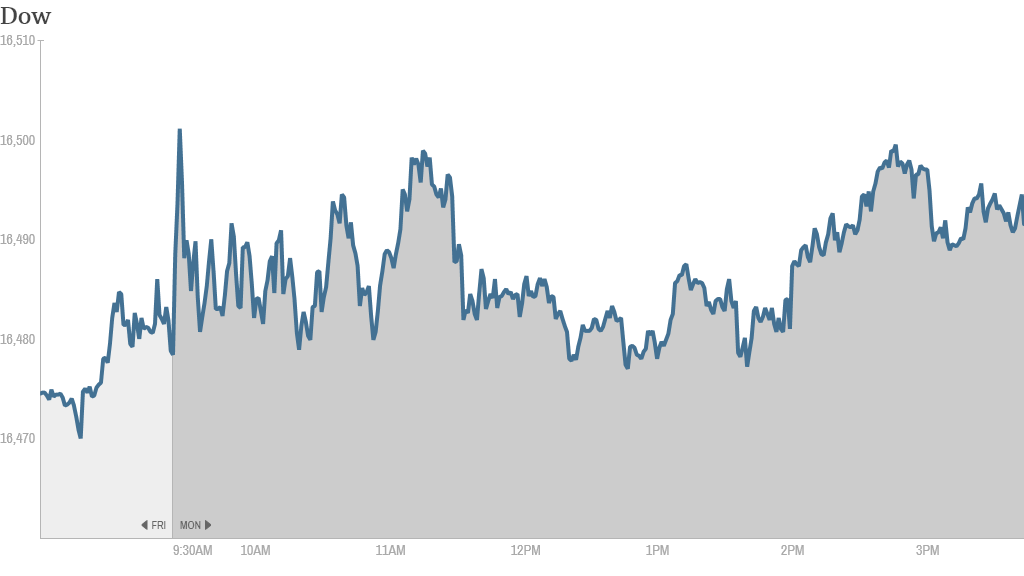

It was a quiet day on Wall Street, but the Dow still managed to notch another record.

The Dow Jones industrial average on Monday posted its 51st closing high of this year. The S&P 500 edged lower, but is still near record highs. The Nasdaq also ended modestly lower.

Trading volumes are expected to be anemic this week as many investors and traders take time off work. U.S. markets will be closed Wednesday for New Year's Day.

"The markets in the week ahead are expected to be subdued given the holiday-shortened trading across the globe and a lack of substantive economic releases scheduled," said Bill Stone, chief investment strategist at PNC Wealth Management.

Stocks ended little changed Friday, but they're capping off a stellar year.

All three indexes have risen more than 25% in 2013. The Dow is on track for its biggest annual gain since 1996, and the S&P 500 is on pace for its strongest year since 1997.

Crocs (CROX) shares surged 21% after private equity firm Blackstone Group (BX) agreed to invest about $200 million in the company. The footwear maker also announced a $350 million stock buyback and said CEO John McCarvel was retiring.

One trader was kicking himself for missing the move in Crocs shares. "Pretty disgusted w/ myself for not getting long $CROX this morning. bid was a few cents too low..." said StockTwits user sspencer_smb.

Related: Fear & Greed Index gets greedy

Cooper Tire & Rubber (CTB)canceled plans to be bought by India-based Apollo Tyres for $2.5 billion. The companies announced the deal in June, but Cooper said Apollo breached the agreement and that its financing fell through.

Cooper shares rose 5% on the news, but at least one trader was still cautious.

"$CTB agreement with apollo, short term bullish but could sell off later," said StockTrend.

Shares of Twitter (TWTR) sank 6%, extending Friday's sharp losses. The selling comes after a strong rally over the past few weeks. Twitter shares have gained 130% since the company's November IPO.

Some traders welcomed the selling, saying Twitter shares had run up too far too fast.

"$TWTR Majority 58% of market today is saying ;- BRING THIS DOWN. IT IS TOO EXPENSIVE," said TradeYodha.

Shares of Alcoa (AA) fell amid reports that Ford (F) will reveal in January that it will use military grade aluminum in its best-selling F-150 pickups.

On the international front, European markets ended modestly lower. A controversial "millionaire tax" is set to become law in France, where the government will levy a 75% tax on companies that pay salaries in excess of €1 million.

Japan's Nikkei closed the year on a high note, rising 0.7%. Tokyo stocks have soared as Prime Minister Shinzo Abe unleashed a massive monetary and fiscal stimulus program.

The Nikkei surged 57% over the past 12 months, the biggest annual gain since 1972, said Emily Nicol, an analyst at Daiwa Capital Markets. The gains make Japan one of the top performing global markets. Japanese stocks have been supported by a weak yen, which has helped Japanese exporters. The yen fell through ¥105 versus the dollar for the first time since 2008.