Investors were hoping to claw back some ground Monday following a week of losses.

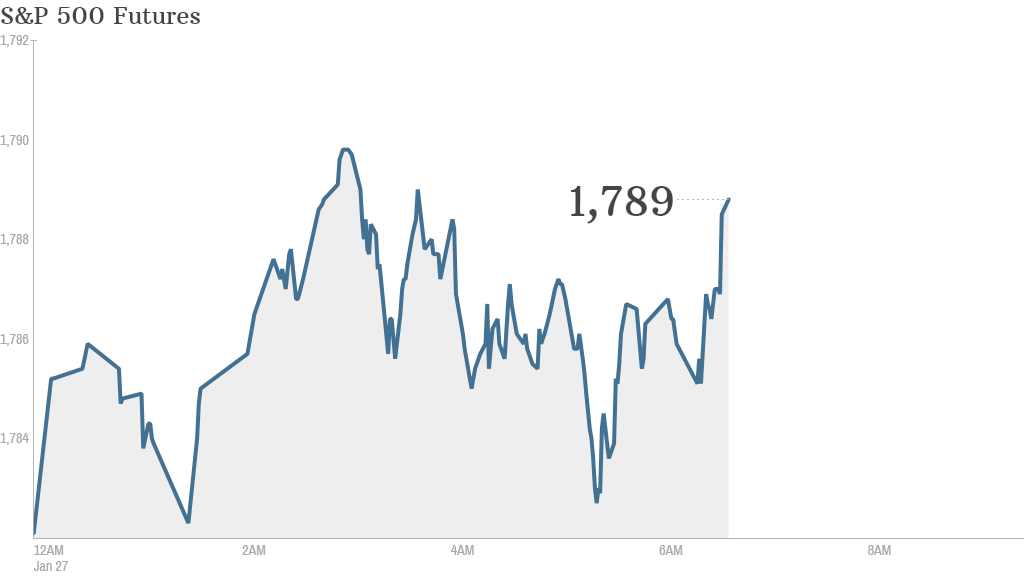

U.S. stock futures edged higher ahead of the open, while global markets remained under pressure.

Last week was a rough one for U.S. stocks. The Dow Jones industrial average shed around 2% Friday to end the week down 3.5%. The Nasdaq and S&P 500 both closed more than 2% lower Friday, and also posted losses for the week.

Emerging markets extended recent losses Monday amid worries about an economic slowdown and liquidity shortfalls.

"So the tide is coming out of emerging markets," said Dominic Rossi, chief investment officer for Fidelity Worldwide Investment, in a market report. "The prospect of the end of cheap money in the west, with the certainty of the end of even cheaper money in China, is forcing up the cost of capital across the [emerging markets] asset class."

Related: Fear & Greed Index slides into fear

Corporate news: Google (GOOG) announced it acquired London-based artificial intelligence firm DeepMind Technologies. It's the latest in a series of start-up purchases by the tech giant as it looks to beef up its expertise in artificial intelligence and robotics.

Sony (SNE) shares lost 2.3% in premarket trading after the firm's debt rating was downgraded to 'junk' by Moody's, with the agency warning that profitability at the tech company would likely remain weak and volatile.

Shares of Caterpillar (CAT) rallied after the company easily blew past earnings and sales estimates, and approved a new $10 billion stock buyback program.

Apple (AAPL) is scheduled to report results after the closing bell.

In economic news, data on new home sales will be announced at 10 a.m. ET.

Related: Emerging markets rattled as anxiety rises

World markets: European stocks fell in morning trading, with London FTSE 100 index losing 1%.

Shares of Vodafone (VOD) tumbled 5% in London after AT&T (T) said Monday it would not purchase the British telecom company. There had been recent speculation that a bid was imminent.

British oil and gas firm BG Group (BRGYY) was another weak spot, with shares plunging 15% after the company warned investors that it faces challenging business conditions.

Related: Tata Motors exec dead after Bangkok hotel fall

Asian markets ended in the red. The biggest loser was Japan's Nikkei index, which closed down 2.5%.