In his State of the Union address, President Obama announced plans to create a new 'myRA' retirement account aimed at helping millions of Americans to start building a nest egg.

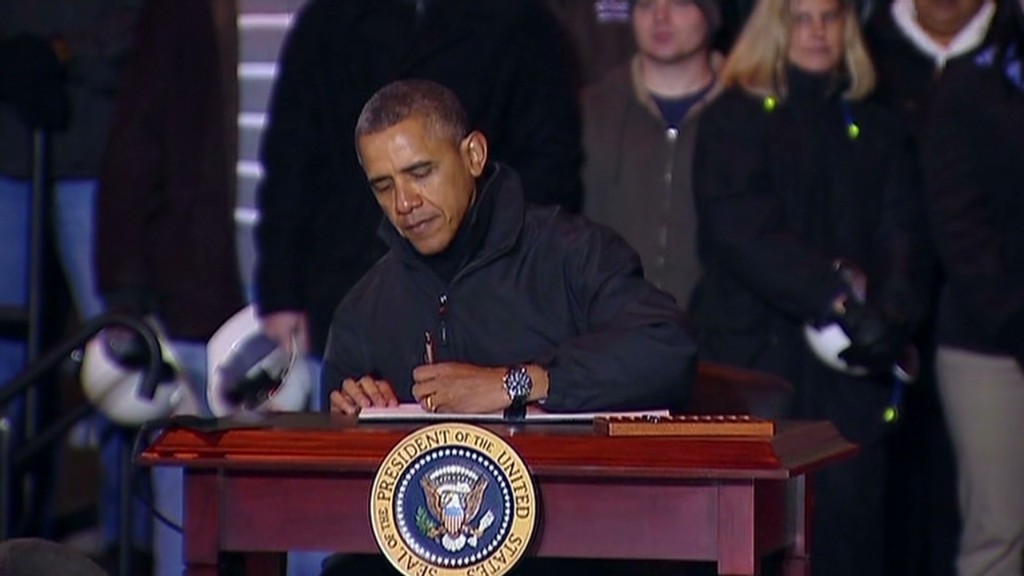

On Wednesday, Obama signed a presidential memo directing the Department of Treasury to create the government-backed retirement accounts.

Here's a look at how myRAs will work, according to the White House:

Who can open a myRA? The accounts are targeted at the millions of low- and middle-income Americans who don't have access to employer-sponsored retirement plans. That includes roughly half of all workers and 75% of part-time workers.

The White House says it will "aggressively" encourage employers to offer the program, noting that they won't have to administer or contribute to the accounts. myRAs will initially be offered through a pilot program to workers whose employers sign on by the end of the year.

Once the program reaches full implementation, anyone who has direct deposit for their paycheck will be eligible to sign up, Treasury said.

Share your story: Would you open a myRA account?

All workers may invest in the accounts, including those who would like to supplement an existing 401(k) plan, as long as their household income falls below $191,000 a year.

How will the account work? The account will function as a Roth IRA, which allows savers to invest after-tax dollars and withdraw the money in retirement tax-free.

But unlike traditional Roth IRAs, the accounts will solely invest in government savings bonds. They will also be backed by the U.S. government, meaning that savers can never lose their principal investment.

Workers will be able to keep the accounts when they switch jobs or contribute to the same account from multiple part-time jobs. They will also be able to withdraw their contributions at any time without penalty. However, anyone who withdraws the interest they earned in the account before age 59 1/2 will get hit with taxes and a possible penalty, just like a Roth IRA.

Another plus: while private retirement accounts of any size can come with a host of administrative expenses, the myRAs will be free of any fees.

Related: Explaining Obama's myRA

"This deals with the small saver problem," said David John, senior strategic policy adviser at the AARP Public Policy Institute. "Very often the administrative costs of those tiny accounts actually eat into the principal."

How much can I invest? Initial investments can be as low as $25 and workers can contribute as little as $5 at a time through automatic payroll deductions. Like a traditional Roth account, savers will be allowed to contribute up to $5,500 a year under current limits.

Once a participant's account balance hits $15,000, or the account has been open for 30 years, she will have to roll it over to a private sector Roth IRA, where the money can continue to grow tax-free. Workers will have the option to switch to a Roth IRA at any time.

What kind of returns can I expect? While the accounts will offer a safe place for many first-time retirement savers to put their money, they shouldn't expect big returns.

The White House said the accounts will earn the same rate as the Thrift Savings Plan's Government Securities Investment Fund that it offers to federal workers. That fund earned around 1.5 % in 2012, and had an average annual return of 3.6% between 2003 and 2012.

Related: Will you have enough to retire?

With an average 2% interest rate, for example, a worker contributing $100 a month would accumulate around $6,300 in savings after five years, including around $300 in interest.

"The good news is you don't have any risk on this account," John said. "The bad news is of course you're not going to have a huge amount of earnings on this account either."

Will this help solve the retirement savings crisis? Retirement advocates are cheering the new savings program as an important step. But no one thinks this alone will fix the fact that millions of Americans have little-to-no retirement savings.

Obama's annual budget will again include a separate proposal to automatically enroll workers in IRA accounts, a long-touted plan which would require Congressional approval.

"This is a start," John said. "Without the actions of Congress, there is a limit on what can be done."