Good riddance to a cold January, and we're not just talking about the weather.

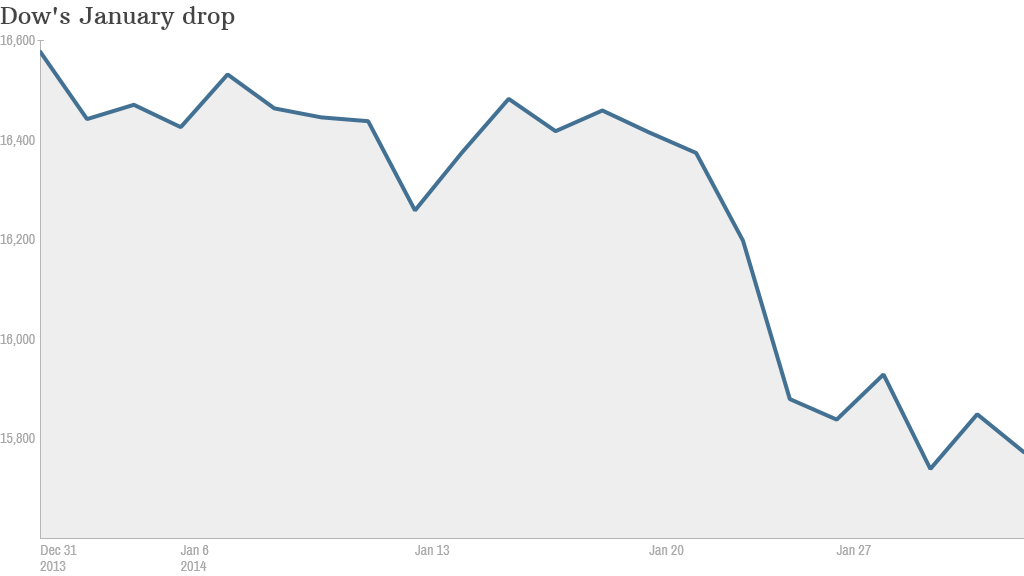

Stocks dropped sharply during the first month of the year, with the Dow tumbling more than 5%. That was the Dow's worst January since 2009, when stocks were still in freefall in the aftermath of the financial crisis.

The S&P 500 slipped more than 3% this month, while the Nasdaq has shed nearly 2%.

Stocks have been hit particularly hard during the past two weeks due to emerging market worries and weak earnings.

Those factors also pressured the market on Friday. The Dow fell more than 150 points, or almost 1%, while the S&P 500 lost 0.7%, and Nasdaq declined 0.5%.

As stocks continued to lose ground, CNNMoney's Fear & Greed index, which measures seven indicators of market sentiment, fell further into "Extreme Fear" mode.

Related: Market volatility ahead. But don't panic!

The market pullback hasn't been a total surprise though, given how well stocks did in 2013. Many experts believe stocks could continue to drop before resuming their upward trend.

"Frankly, we've been telling clients to expect a 5% to 10% decline," said Matt King, chief investment officer at Bell Investment Advisors. "We didn't think it would happen so early in the year, but it's been such a good run for markets that a meaningful correction is normal and healthy."

While stocks took a small step back last spring, they haven't experienced a correction, typically defined as a decline of 10% or more, in more than two years.

But King still thinks stocks will end the year with modest gains.

"We think the declines could spill over into February, but we're telling clients to buy into this weakness as well," said King. "We don't think this is anything more than a normal correction."

Related: No Terrible Twos for Facebook stock

On the earnings front Friday, Mattel (MAT), Amazon (AMZN), Chevron (CVX) and MasterCard (MA) were all big losers on Friday after reporting results that underwhelmed investors.

Mattel shares tumbled after the toy giant reported a surprise drop in its fourth-quarter revenue, as sales of its core brands Barbie and Fisher-Price fell sharply.

Amazon missed Wall Street's earnings forecasts, sending shares sharply lower. It was the worst performer in CNNMoney's Tech 30 index. Amazon also disclosed that it is considering doubling the membership price of Prime to $40 to cover rising fuel and shipping costs, a topic that generated plenty of chatter among traders on StockTwits.

"Explain again how raising Prime fees will increase growth?" asked SkepticalBull. "Oh yeah, that's right. It doesn't. It's a band-aid on a gunshot wound. $AMZN. Bearish."

But others came out in defense of the company.

"If Amazon is really losing money on Amazon Prime, of course it makes sense to raise the prices $AMZN," said ivanhoff.

Wal-Mart (WMT)shares were flat after the discount retailer cut its guidance for the fourth quarter.

On the bright side, Google (GOOG) and Chipotle (CMG) were all higher and hit new all-time highs following their earnings reports.

"$CMG $GOOG Have a Burrito while Googling for the next big thing!" joked StockTwits trader strick.

Facebook (FB) shares also rose to new all-time highs. Shares of Facebook doubled in 2013 and have continued to rise this year, as the company continues to succeed with its mobile advertising strategy. Traders are hopeful that the stock will continue to gain ground.

"$FB Hope this become a more stable stock now with slow but continuous upwards movement...Bullish," said Heiko.

StockTwits trader vanhalenboss was also optimistic: "$FB Great company, great management team, great vision and executing in every category....BUY."

Zynga (ZNGA) was also higher, but the company also announced a new round of job cuts.

Microsoft (MSFT) shares ticked up slightly following a Bloomberg report that the company is preparing to name executive vice president Satya Nadella as its next CEO.

Related: Worst is yet to come for 'Fragile Five'

Emerging markets were in also in the limelight once again, with the Turkish lira and other currencies weakening further.

The volatility has been sparked by the fact that economic growth is slowing across developing economies and fears that China's shadow banking system could spark a credit crunch.

The Federal Reserve's decision to reduce the size of its monthly bond purchase program has also been weighing on emerging markets. The so-called tapering by the Fed is expected to leader to a stronger dollar, which should make emerging markets less attractive for investors.

In a statement Friday, the International Monetary Fund said "the turbulence also underscores the need for vigilance among central banks over liquidity conditions in international capital markets."