The broader market barely budged Tuesday, as investors digested the latest corporate earnings and a notable drug company merger. But tech stocks remain on a hot streak.

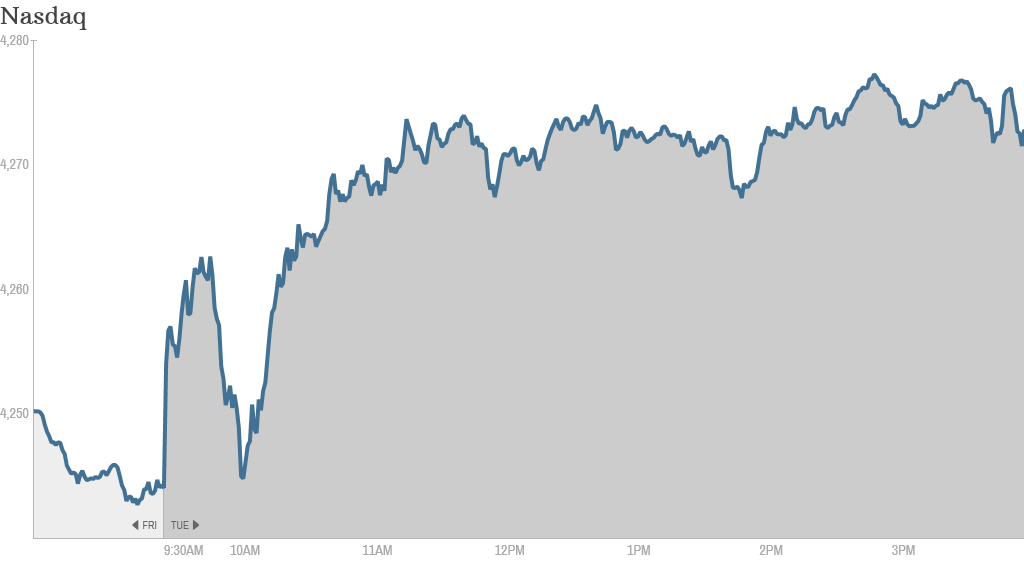

In the first day of trading this week, the Dow finished a tad lower, while the S&P 500 ticked up a bit. The Nasdaq gained for the eighth straight day and closed at its highest level since July 2000. The U.S. market was closed Monday for the Presidents Day holiday.

While the start of the year was rocky for investors, stocks roared back to life last week. The S&P 500 is now only a few points away from its record closing high.

But further gains are only expected if earnings impress Wall Street.

Related: Worst over for stocks? Depends on earnings

The holiday-shortened week is not off to a good start in that regard though. Coca-Cola (KO) dropped almost 4% after the beverage giant reported revenue below analyst estimates. The company's global footprint makes it a good barometer for consumer spending around the world, including emerging markets.

"$KO now u know why they wanted the $GMCR deal, USA soda sales declining. Coffee where its at," said danbetz on StockTwits, pointing to the company's recently announced partnership with Green Mountain Coffee Roasters.

BlackBerry (BBRY) shares spiked over 5% after activist hedge fund manager Dan Loeb disclosed that he acquired a stake in the struggling smartphone maker. The stock was the biggest gainer on CNNMoney's Tech 30 Index Tuesday. Despite a turnaround effort, BlackBerry shares are down over 33% in the last year. But they have rallied this year on hopes that new CEO John Chen will be able to stop the bleeding.

"$BBRY Bumpy it will be, it's a much hated BlackBerry...But that is changing since John Chen climbed on board," commented StockTwits trader JohnLBair1.

"$BBRY Loeb definitely trusting Chen management to turn around BB just like he did with Marissa when she took over Yahoo," said StockTwits user TwitsTrader, referring to Loeb's success in helping to install Yahoo! (YHOO) CEO Marissa Mayer to try and rejuvenate the online media company.

In other corporate news, Actavis (ACT)agreed to buy Forest Laboratories (FRX) for $25 billion in a deal announced Tuesday. Shares of both pharmaceutical companies surged on the news. Forest jumped 30% while Actavis was up 7%.

The deal is yet another big win for activist investor Carl Icahn, who is a major shareholder in Forest Labs and helped spur changes in the company's management last year.

"Great result for ALL $FRX (Forest Labs) shareholders - proves again that activism works," Icahn tweeted Tuesday.

"I'm beginning to kinda like this Icahn guy. $FRX," quipped BeyondPale on StockTwits.

1-800-Flowers (FLWS) shares plunged after the delivery service spent the weekend apologizing to customers whose flowers and candy never showed up.

Shares of Netflix (NFLX), another member of CNNMoney's Tech 30 Index, moved slightly higher Tuesday despite reports that the company's move to strike a deal with Time Warner Cable (TWC) for a place on the cable company's set-top boxes has slowed. Investors are hoping the success of season two of Netflix's hit series "House of Cards" will continue to lift the stock.

King Media Entertainment, the maker of the popular online puzzle game Candy Crush, filed to for an initial public offering. Shares of Zynga (ZNGA), another developer of mobile and online games, rose about 4% on the news.

But one trader felt Zynga can stand on its own.

"$ZNGA Forget Candy Crush IPO news, Zynga the one to watch in mobile gaming," said BullzNBearz.

Related: Fear & Greed Index moves closer to neutral

European indexes and Asian markets both closed mixed. The Nikkei added 3.1% after Japan's central bank doubled the size of two programs designed to encourage bank lending.