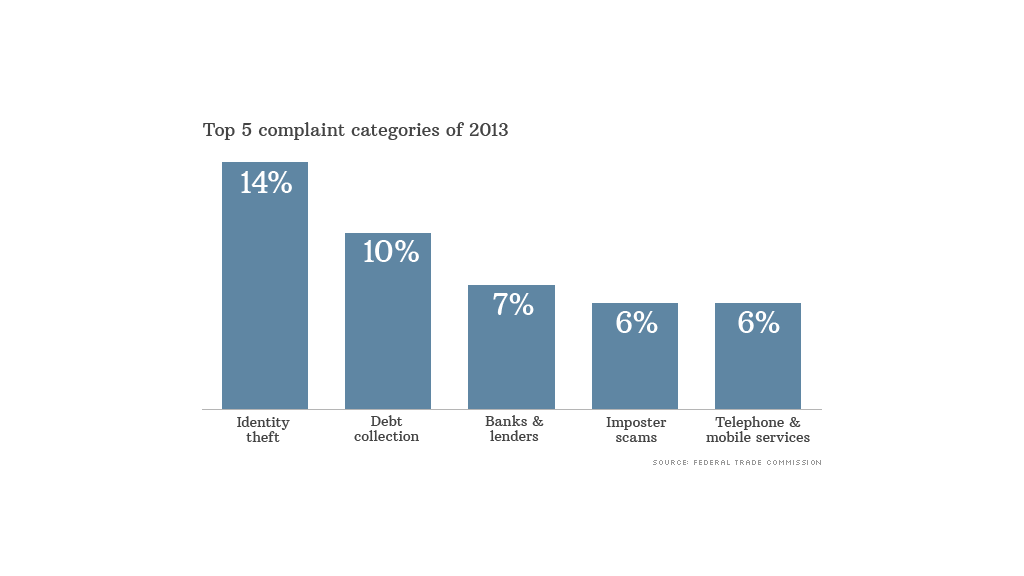

Identity thieves were once again consumers' greatest gripe last year, followed by pesky debt collectors and frustrating banks and lenders.

Of the more than 2 million complaints made to the Federal Trade Commission, law enforcement and consumer protection agencies, nearly 300,000 (or 14%) were related to identity theft, according to the FTC's annual tally.

Beyond identity theft, the agency received more than 1.1 million complaints about various fraud schemes, which led to losses of more than $1.6 billion for consumers. The FTC did not have an estimate of identity-theft related losses.

Related: New scam targets homeless

Roughly a third of the identity-theft complaints came from consumers who said their personal information had been stolen and used in government documents, such filing a false tax return or applying for government benefits.

Meanwhile, around one-quarter of the identity-theft complaints were about bank or credit card fraud.

Rounding out the top three complaints were problems with debt collectors (10%), including repeated or profane phone calls and misrepresentations of the amounts owed, followed by complaints about banks and lenders (7%), ranging from the use of predatory lending practices to fees and overdraft charges.

Related: Debit vs. credit cards: Which is safer to swipe?

Many consumers said they had fallen victim to other frauds as well, including phony sweepstakes and so-called "imposter scams," a popular scheme where fraudsters pose as a loved one in need.

Florida, Nevada, California and Georgia were complaint hotspots, with the highest ratios based on state populations.