The day after celebrating 5 years of the current bull market, investors are looking sluggish Monday.

Asian indexes tumbled on weak data from the world's second and third biggest economies, and European markets were mixed as tension over the crisis in Ukraine lingered.

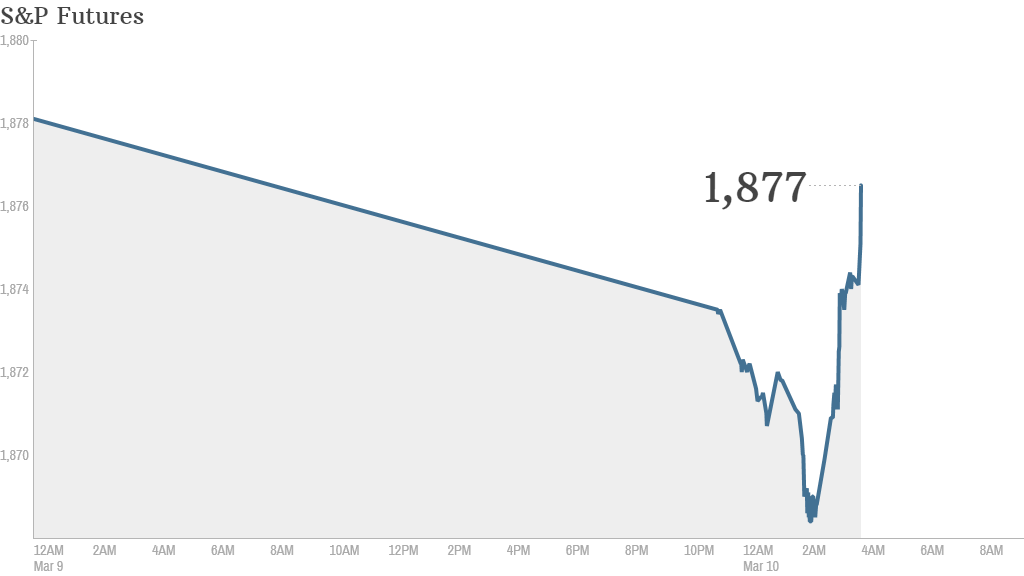

U.S. stock futures were slightly softer.

Boeing (BA) shares traded nearly two percent lower pre-market after Malaysia Airlines Flight 370, a Boeing 777, disappeared Saturday in mysterious circumstances en route to Beijing. The company also announced late Friday that "hairline cracks" had been found on some of its Dreamliner 787 jets still in production.

Related: Winners and losers of the bull market

Chiquita Brands said it was buying Ireland's Fyffes for about $526 million to create the world's leading banana company.

Otherwise, there's little U.S. economic or corporate news on the docket Monday. The World Agriculture Supply and Demand report will be published at noon ET. Urban Outfitters (URBN) will report earnings after the bell.

Related: Fear & Greed Index is in extreme greed

U.S. stocks ended mixed Friday. The Dow rose 0.2%, while the S&P 500 added a single point. But that was enough to finish at another record closing high. The Nasdaq ended in the red, as big declines in biotech stocks weighed on the index.

Sunday was the fifth anniversary of the starting point of the current bull market. While some investors worry that stocks are overdue for a pullback, bulls say there's more room to run.

European markets were mainly higher in morning trading, with the exception of Germany's DAX. Asian markets ended significantly lower after China trade data and revised Japanese GDP numbers came in weaker than expected.