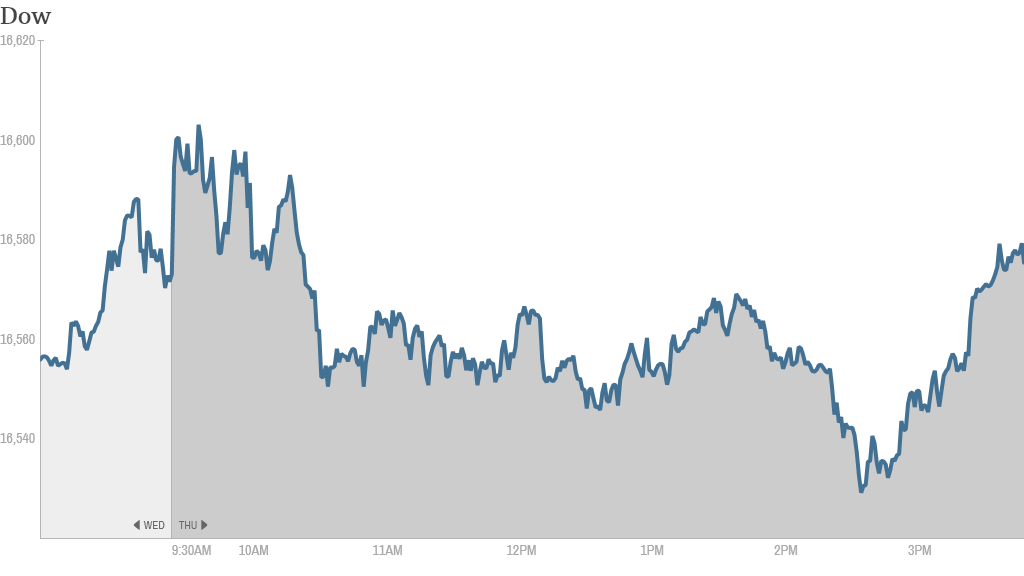

Investors must have eaten their Wheaties this morning, but forgotten their afternoon protein shake. Stocks hit new milestones Thursday shortly after the markets opened before pulling back.

The Dow ended flat while the S&P 500 closed slightly in the red. Both indexes hit record highs earlier in the day. The Nasdaq also fell almost 1%.

US markets had been on a roll this week. On Wednesday, the S&P 500 closed at a new high, it's eighth of the year. But the question remains as to whether this momentum will continue.

Investors are keeping an eye on U.S. jobs and Europe's economy. The big March unemployment report is due tomorrow. Today the Labor Department released jobless claims data for late March, and it was worse than expected, raising concerns about what could be coming on Friday.

Across the pond, the European Central Bank said it will keep its key interest rate unchanged at 0.25%, as widely expected. But the central bank is facing growing pressure to do more to stimulate the Eurozone economy as risks of deflation rise and the euro remains stronger than some would prefer.

ECB President Mario Draghi tried to use words to calm the markets. He affirmed in a press conference the bank's commitment to keep inflation at a healthy level, but he didn't announce any new measures to prop up the economy.

Still, he said said the ECB's governing body is considering a quantitative easing strategy similar to that deployed by the Federal Reserve.

European markets finished mixed following the announcement.

Related: Fear & Greed Index in neutral mode

In corporate news, newly issued Google shares started trading Thursday as a result of the tech giant's long-anticipated 2-for-1 stock split. The new class C shares, which trade under the original "GOOG," symbol and have no voting rights, rose in morning trading before going negative in the afternoon.

Old Google class A shares, which retained their voting rights and trade under the new symbol, "GOOGL," went up in the morning and then fell back.

Shares of both classes of Google began trading at around $570, but the A shares have maintained a higher share price all day, as expected.

Some traders on StockTwits were caught off guard by the split.

"$GOOG woah, just saw this and freaked out, never mind, nothing to see here," said barna.

"Pretty fun watching the $GOOG craziness here today!," said DontTalkStocks.

Related: Google's (share) class divide

Barnes and Noble (BKS) plunged 13.5% after one of its largest shareholders, John Malone's Liberty Media Corporation (LMCA), announced that is reducing its stake in the struggling bookseller. Barnes and Noble has bounced back over 25% this year after being one of the worst performers in the S&P 500 in 2013.

In a press release, the Liberty Media said the move would give Barnes and Noble "greater flexibility to accomplish their strategic objectives."

But one StockTwits trader didn't agree.

"I don't buy the flexibility argument. I would rather have Malone on my side. $BKS," said MicroFundy.

Related: Another bad chapter for Barnes & Noble

Shares of Pandora (P) ticked down after initially jumping after the internet radio service released figures showing notable jumps in its number of active listeners in March. The number of hours listened for the month also rose.

Netflix (NFLX)continued its slide Thursday. After a huge run, shares of the entertainment site have pulled back about 20% in the past month as the company faces growing concerns about its high valuation and increasing competition.

Yelp (YELP) shares lost nearly 7% after falling more than 5% Wednesday after the Wall Street Journal reported that the review site receives around six subpoenas each month, often relating to business owners suing the company.

But StockTwits trader lossaverse didn't think Yelp was going away anytime soon.

"$YELP What is the alternative? The Yellow pages? They can fix this problem," he said.

FireEye (FEYE), a cybersecurity firm that many analysts thought would benefit from selling software to root out hackers after the Target credit and debit card data breach, plunged 11% Thursday after receiving an unfavorable rating from advisory firm NSS Labs. But the stock is still up over big from its December IPO.

Twitter (TWTR)continued its downward slope today. The stock has been falling back ever since it forecast slowing sales and user growth in its fourth quarter earnings report.

Asian markets ended mixed, shrugging off news of a mini-stimulus package in China. After an initial boost, the Shanghai Composite closed 0.7% lower. Hong Kong's Hang Seng finished narrowly firmer.