Company earnings and the Fed are likely to take center stage Wednesday as markets show signs of steadying after a sharp plunge.

The Federal Reserve will release minutes from its March meeting at 2 p.m. ET Wednesday.

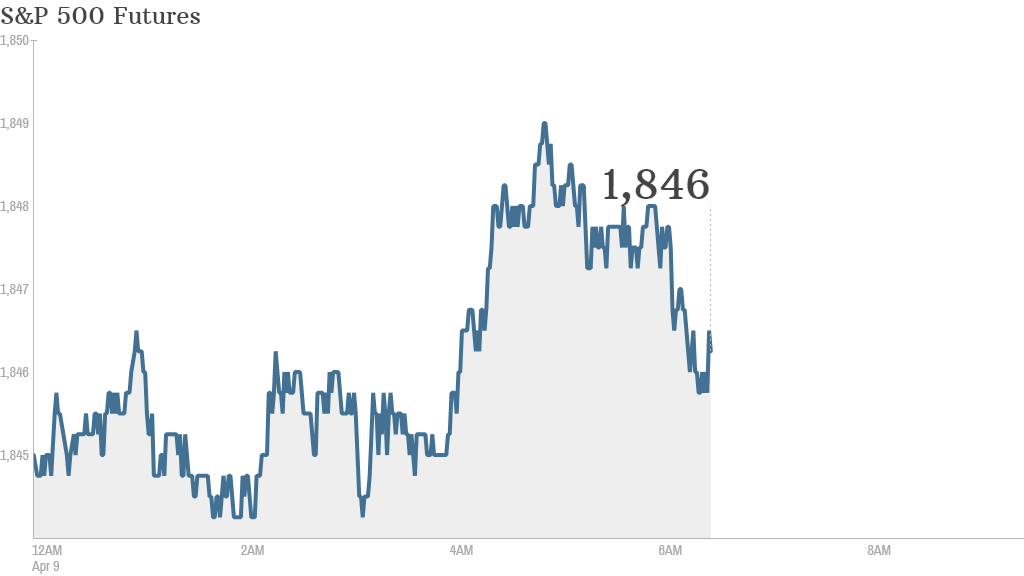

U.S. stock futures were moving higher.

Auto stocks could see some pressure after Toyota (TM) announced a massive global recall. General Motors (GM), grappling with the continuing fallout of its botched ignition switch recall, fell in premarket dealing.

In corporate news, Bed Bath and Beyond (BBBY) will report earnings after the closing bell. Comcast (CCV) and Time Warner Cable (TWC) representatives will appear before the Senate Judiciary Committee to plead their case for merging the companies.

Related: Fear & Greed Index still gripped by fear

Earnings will be the next big catalyst for markets, wrote Deutsche Bank analyst Jim Reid, noting that Alcoa's quarterly report after the closing bell Tuesday marked the unofficial start to the season.

"We'll only start to get a firmer picture of earnings growth around this time next week, after the first of the U.S. major banking groups have reported," he added.

Shares of aluminum producer Alcoa (AA) rose in premarket trading after it reported quarterly earnings that topped analysts' expectations.

Shares of medical robotics company Intuitive Surgical (ISRG) dropped in premarket trading after the company said it expects first quarter revenue to come in 24% lower than the same quarter last year.

U.S. stocks bounced back Tuesday, closing higher after a brutal sell-off over the three previous trading days. The Dow, S&P 500 and the Nasdaq all gained less than 1%.

The S&P 500 moved back into positive territory for the year. But the Dow and Nasdaq are still down over 1.5% each.

European markets were moving cautiously higher in morning trading.

Most Asian markets also managed gains, led by Hong Kong's Hang Seng with a 1.1% rise and Australia's ASX All Ordinaries adding 0.9%. Japan's Nikkei continued its decline, falling 2.1%, as hopes fade of more central bank stimulus. Toyota closed down 3%.