President Obama and First Lady Michelle Obama reported an adjusted gross income of $481,098 for 2013 -- about 21% less than the year before.

The bulk of their income came from the president's salary, but the Obamas also reported roughly $100,000 in business income from Random House and literary management company Dystel & Goderich.

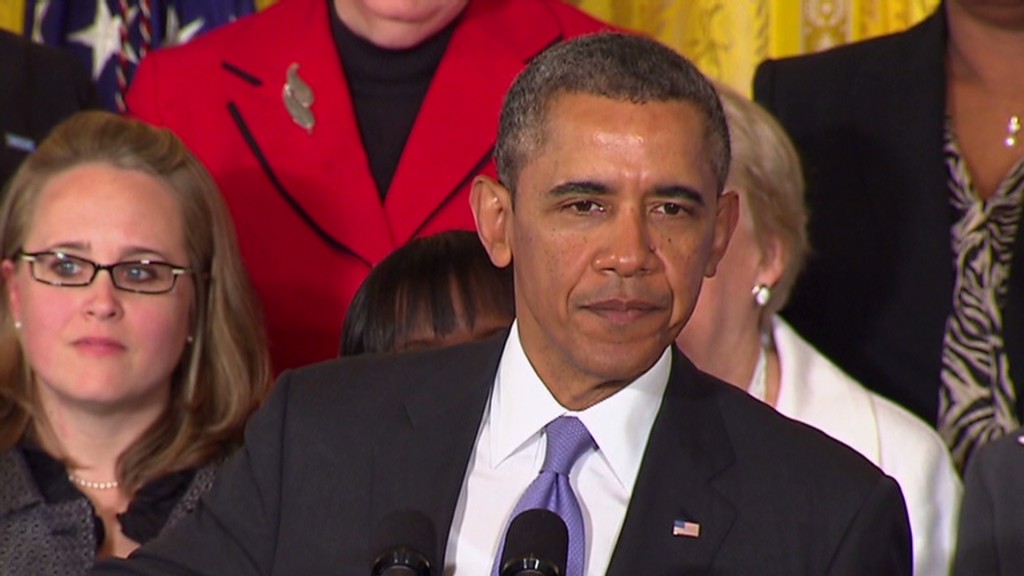

The White House released the couple's 2013 federal tax return on Friday.

Their federal tax bill for 2013 came to $98,169, according to their return. That's an effective federal tax rate of 20.4% on the First Family's AGI.

But because they already paid $117,277 in federal taxes, they're due a big refund of $19,108. They opted to have it applied to their 2014 taxes.

Related: 4 ways the rich will pay more in taxes

Like a lot of very high-income Americans, the Obamas were subject for the first time to the additional Medicare tax that went into effect in 2013 to help pay for the president's signature health reform law.

The extra tax cost them an additional $2,310.

They also owed $136 in additional Medicare taxes on $3,578 in net investment income. Also as a result of Obamacare, net investment income is now subject to a 3.8% Medicare tax for people making more than $250,000.

And like roughly a third of all U.S. tax filers, the Obamas are itemizers. They claimed $147,769 in itemized deductions, the biggest of which was $59,251 in charitable contributions to organizations such as the Fisher House Foundation, American Red Cross and CARE.

A distant second was $42,383 deduction in mortgage interest.

Unlike a lot of Americans, the Obamas put aside a lot for their retirement, saving $20,681 in tax-advantaged retirement plans.