Detroit's emergency manager and pension funds for 23,000 workers and retirees hammered out tentative deals on Tuesday, marking a major step forward in the city's efforts to exit bankruptcy.

If approved, the deals would significantly limit proposed cuts in pension benefits compared to what had previously been proposed.

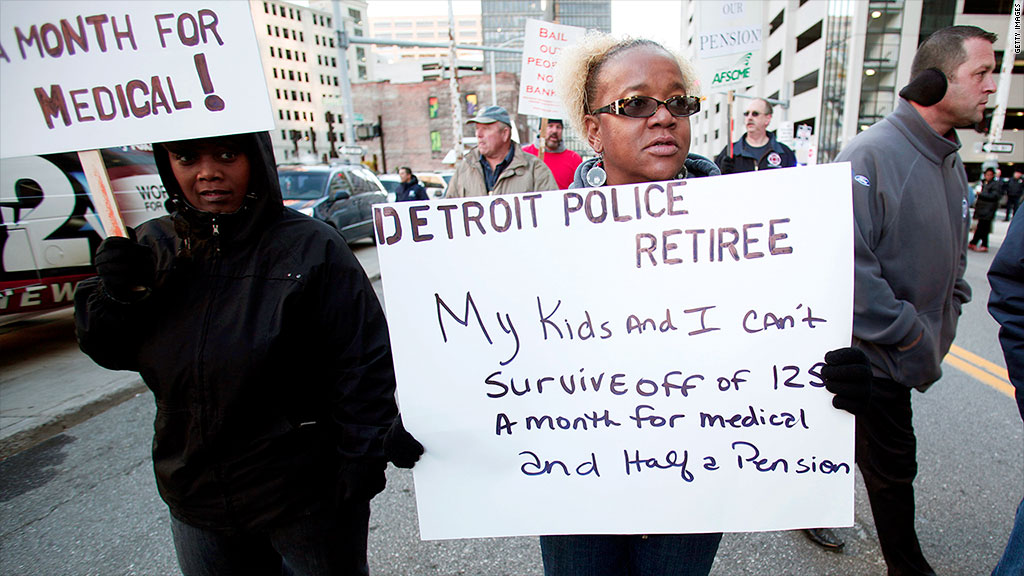

The first deal was reached with the Retired Detroit Police and Fire Fighters Association, which represents more than 80% of Detroit's retired public safety workers. Retirees would suffer no cuts to their current pension benefits and would receive nearly half of their annual cost of living increases moving forward.

Later Tuesday, the city struck an agreement with the General Retirement System, an even larger fund that covers civilian workers for most city departments.

The general fund was in worst financial shape than the one that covered police and fire fighters. Those retirees would see a 4.5% reduction in benefits and lose their cost-of-living adjustment altogether.

Both sets of cuts are far smaller than the those proposed in February by Kevyn Orr, the emergency manager overseeing Detroit's finances and bankruptcy proceedings.

In laying out his original plan to reorganize Detroit, Orr proposed a cut of up to 34% for most retirees, and up to a 14% cut for police and fire.

Related: How Detroit's bankruptcy impacts my life

The city, which filed for bankruptcy last July, has proposed shedding nearly $10 billion in unfunded liabilities in the largest municipal bankruptcy ever. More than $3 billion of that gap was the estimated underfunding in pension funds.

The biggest liability on Detroit's books is the cost of health care for current and future retirees and their families. And retirees are likely to see deeper cuts in their original coverage as part of this deal. Bankruptcy court mediators said Tuesday a fund would be established for retiree health care costs but did provide details.

Related: Detroit to auction vacant homes online

The trustees of the General Retirement System approved its deal on Wednesday. The trustees of the police and fire fund have yet to act. Both agreements must still be voted on by rank-and-file city retirees and workers.

The city is preparing to send out ballots to tens of thousands of creditors, including workers and retirees who will be asked to vote in favor of cutting their pension benefits. While it may sound counter-intuitive, Orr has said a "no" vote would result in deeper pension cuts.

Arthur Versace, a 62-year-old retired fire captain who currently receives around $45,000 a year from his pension, said that he would "definitely" vote in favor of the deal.

"There is no way I'd say no," he said. "I think you'd be crazy not to take that."

Orr has repeatedly pressured labor groups to negotiate so the city can move forward from its historic bankruptcy proceedings, which have already racked up millions in legal and consulting fees, and return focus to providing essential city services.

Tuesday's deals will ultimately rely on funding provided by a "grand bargain" offered by private foundations, state officials and the Detroit Institute of Arts that pledged $816 million toward retiree pensions. In return, Detroit would relinquish control of city-owned art to the museum.

But the city's exit from bankruptcy will eventually rely on the final approval of bankruptcy judge Steven Rhodes.

Michael Sweet, a California-based attorney at Fox Rothschild and expert in municipal bankruptcy, said this is the most significant step Detroit has taken yet toward emerging from bankruptcy.

"This is a real feather in Kevyn Orr's cap. Having retirees go into court with him on a plan would send a very strong message to the court and other creditors," he said.

Sweet said this kind of agreement seemed unlikely not long ago given the positions being staked out by both Orr, the pension funds and the city's unions, but "pressure makes diamonds."

--CNN's Poppy Harlow contributed to this report.