Lambasting corporate tax "loopholes" makes for a rousing populist speech.

But when it comes to how much revenue Uncle Sam gives up every year because of tax breaks, the greatest amount by far goes to individual taxpayers.

And "by far," think close to 90%.

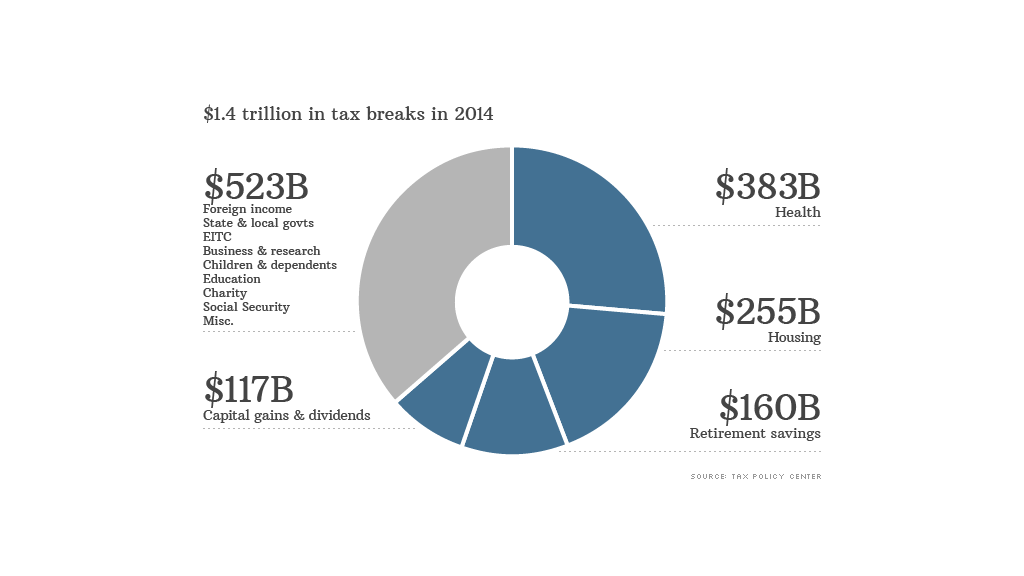

More than $1 trillion of the estimated $1.4 trillion in so-called tax expenditures this year will benefit individuals, according to a new analysis from the Tax Policy Center.

By contrast, just $148 billion in tax breaks will go to corporations.

That represents less than half the cost of health-related tax expenditures -- the No. 1 category, costing an estimated $383 billion.

Related: $100,000 income: Three very different tax bills

The biggest player in this group is the exclusion for employer-sponsored health insurance, worth more than $300 billion. This is the tax-free compensation a worker enjoys when his employer pays for a portion of his health insurance policy.

Also in this group is the new premium assistance offered to low- and middle-income families under Obamacare, worth about $34 billion, according to the analysis, which was published in Tax Notes.

Housing is the next biggest category, accounting for $255 billion of the $1.4 trillion. Among the biggest players here are the mortgage interest deduction, the property tax deduction, and the tax-free treatment on the first $250,000 in capital gains ($500,000 for married couples) on the sale of a home.

Third up are the $160 billion in tax breaks offered for pensions and other types of income security, such as the deduction for 401(k) contributions and the tax-free treatment of Roth IRA withdrawals.

And fourth in line is the $117 billion tax break on investment income -- namely, capital gains and dividends, which are often taxed at a lower rate than ordinary income.

All told, the top 4 categories of tax expenditures account for more than 60% of the $1.4 trillion in forgone revenue.

And that $1.4 trillion is the equivalent of nearly half of the total federal revenue the government is likely to collect this year.