It's jobs day, and investors like what they've seen.

The Labor Department said Friday that the economy added 288,000 jobs in April, far better than the 205,000 jobs economists surveyed by CNNMoney had predicted. The unemployment rate fell to 6.3% in April, down from 6.7% in March and beating the 6.6% forecast expected by economists.

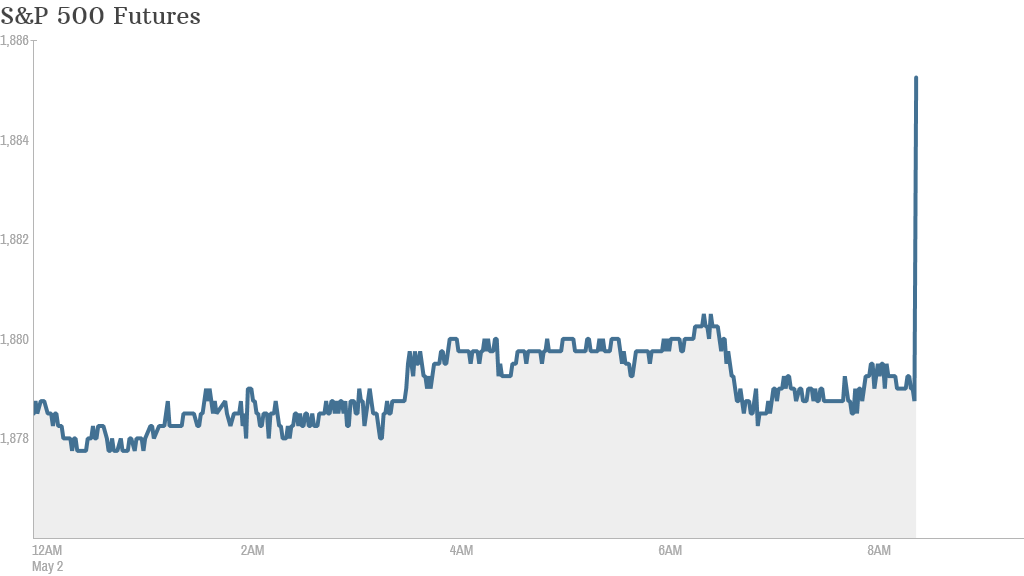

U.S. stock futures rose on the news.

The dip in the unemployment rate was mostly due to fewer unemployed people entering the workforce. Still, the number of jobs added was impressive by other measures, with the professional services, construction, and food and beverages sectors showing strength.

Related: Fear & Greed Index still gripped by fear

In corporate news, shares in AstraZeneca (AZN) were flat in premarket trading after the company rejected an improved bid for the British company from Pfizer (PFE)worth £50 ($84.47) per share, or $106.4 billion. Pfizer shares were inactive premarket.

"The financial and other terms described in the proposal are inadequate, substantially undervalue AstraZeneca and are not a basis on which to engage with Pfizer," AstraZeneca said in statement.

Shares of CVS fell in premarket trading after the company's earnings came in short of estimates.

U.S. stocks closed mixed Thursday. The Dow Jones industrial average and S&P 500 closed slightly lower, failing to hit new record highs. The Nasdaq logged modest gains thanks to rebounding social networking stocks.

European markets were mixed in midday trading. New data showed eurozone unemployment remained steady at 11.8% in March, unchanged since December.

Asian markets mostly moved forward Friday, but the gains were modest.