As construction and homebuyer activity in communities across the country demonstrate, the housing market continues to recover. Home prices nationwide were up as much as 13% in the past year, which helped lift four million homeowners from being underwater.

And while the collapse of the housing market was a major cause of the Great Recession, stronger residential investment has helped boost economic growth over the last few years by spurring construction activity and helping American families build back their hard-earned wealth.

|

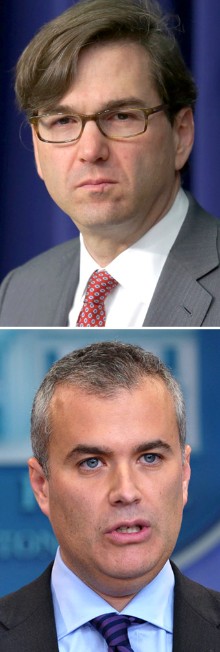

| Jason Furman (top) is chairman of the White House's Council of Economic Advisers, and Jeff Zients is director of the National Economic Council. |

While we are encouraged that the housing market is showing signs of recovery, legacies of the housing crisis linger and continue to make it too hard for families to access the credit they need to purchase a home, holding back economic activity. Today, the credit score that the typical borrower needs to get a guaranteed loan is significantly higher than in the past -- and higher than we would expect given economic fundamentals.

This leaves many responsible borrowers with credit histories that should be eligible for mortgages under normal circumstances unable to find lenders willing to give them a mortgage at an affordable rate. Estimates from Moody's suggest that if the acceptable credit score reverted to the more traditional and sustainable standards that existed prior to the housing bubble, then the pool of potential mortgage borrowers could increase by more than 12.5 million households.

Calculator: Was my home a good investment?

In response, the Federal Housing Administration (FHA) and the Federal Housing Finance Agency (FHFA) took important steps last week to ensure that more responsible, creditworthy families can obtain a loan when they're ready and prepared to buy a home -- while ensuring we do not return to the days of unsound lending practices. These steps respond to a basic question presented in the mortgage data: If responsible borrowers have a credit history that should make them eligible for loans -- especially in a housing market and an economy that is growing stronger -- why haven't these loans been made?

One reason is that lenders are uncertain as to the exact circumstances under which FHA or FHFA, the two primary agencies that determine these "rules of the road," will obligate lenders to repurchase mortgages that would otherwise be guaranteed or insured, which would leave them on the hook for losses.

When it comes to the "rules of the road," this lack of clarity is akin to driving on a highway where you don't quite know the speed limit. The logical reaction is to drive slower -- and slow down traffic -- even if you might actually end up well below the legal limit.

Similarly, a perceived lack of clarity by lenders about how mortgage guarantees will be treated has made them more cautious in lending to eligible borrowers with credit histories that are anything less than perfect.

Related: 'I'm too afraid to sell my home'

Throughout his administration, the president has been clear that where we can take responsible action to strengthen the housing market and the recovery, we should. The administration worked with the FHFA to help 3.1 million low equity and underwater homeowners refinance when rates were low and establish foreclosure prevention programs that have helped millions of families stay in their home. Neighborhood stabilization and blight reduction programs have helped turn hard-hit communities around. The president established a mortgage fraud task force to investigate abusive lending and packaging of risky mortgages.

Last week's actions follow that same approach. The FHA provided assurance that loans that meet their credit guidelines can be originated without fear of penalty and announced additional benefits to borrowers who receive housing counseling services. The FHFA gave new clarity as to the circumstances under which lenders would be required to repurchase defaulted Fannie Mae- and Freddie Mac-guaranteed loans.

And the early reactions suggest that these efforts have already begun to pay off. Some large lenders, such as Wells Fargo (WFC), have reduced the credit score they are willing to accept for government-guaranteed loans.

As we take these steps to strengthen and provide certainty to today's housing market, we also need a long-term solution that advances the president's principles for comprehensive housing finance reform, a solution that will lead to a safer and more inclusive system.

Last week, Senate Banking Committee Chairman Tim Johnson and Ranking Member Mike Crapo, along with Senators Bob Corker and Mark Warner, advanced the Housing Finance Reform and Taxpayer Protection Act of 2014.

The bill is a strong bipartisan foundation to complete a major piece of unfinished business from the financial crisis.

While we support an active and robust interim role for Fannie Mae and Freddie Mac in sustaining the recovery, legislative reform that secures a safer, stronger, and more resilient housing finance system is essential. We will continue to work with the Senate to address affordability and access to broaden support for this important bipartisan legislation.

There is still much more work we need to do -- but last week marked progress, both in strengthening our housing market today, and building a better long-term solution that supports homeowners and the economy.