It's going to be a short week on Wall Street as the U.S. and British markets are closed on Monday.

The truncated week will also mark the end of a dramatic month for stocks.

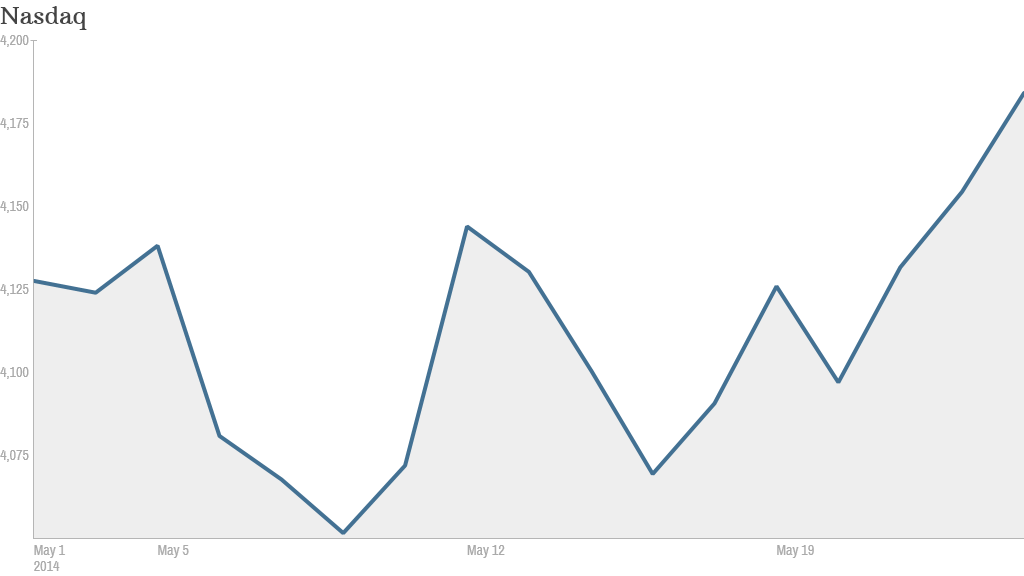

Nasdaq rallies in May

Investors traditionally unload shares before they head off for summer vacation, but sticking it out through May looks like a wise move this year. The Nasdaq is up 1.7% so far this month, shaking off its losses from March and April when there was broad sell-off of so-called "momentum stocks."

Related: Get ready for the summer bummer in the stock market

The Dow and S&P 500 are also on track to end the month higher. On Friday, the S&P 500 closed above 1,900 for the first time ever.

Earnings season is over

Earnings season is nearly over, with 98% of S&P 500 companies having reported quarterly earnings, according to FactSet. To date, 74% of those companies have beaten expectations, but that's partly because the predictions were so low after the harsh winter. Profits are only up 2.1% over the same time last year.

Some of the last firms to report include purse and watchmaker Michael Kors (KORS), due out on Wednesday. Analysts are expecting sales to grow by more than half, but the company wouldn't be the first high-end retailer this quarter to do well.

Related: The 1% drive big gains for luxury brands.

Abercrombie & Fitch (ANF) will report on Thursday, but it is expected to show a decline. Those watching the company think sales are going to fall and profits will turn to losses for the teen retailer.

Lions Gate Entertainment (LGF), the studio behind the popular Divergent film franchise, also reveals performance on Thursday. It is expected to be flat from last quarter, though far better than the same time last year.

Economic data: Consumer confidence

Investors have to wait another week for much anticipated American jobs report, but there are plenty of other big economic releases to dig through as they plan their summer vacations.

Consumer confidence stats drop Tuesday, along with data on home prices. Both are expected to remain relatively flat from the previous month. Initial jobless claims come out on Thursday, and economists predict they will dip lower, which would be a good sign for those hoping for a stronger labor market.

All three economic measures will be picked over by investors seeking clarity on the strength of the recovery.

Related: 3 reasons interest rates will stay low for years

Geopolitical tensions

There's still plenty of geopolitical risk to potentially spook the markets, including deadly violence in the lead up to Ukraine's elections on Sunday. Unrest also continues in Thailand, with the military shutting down international television networks and banning some politicians from leaving the country following a coup d'etat.

So far, these events have not had a major impact on world markets.