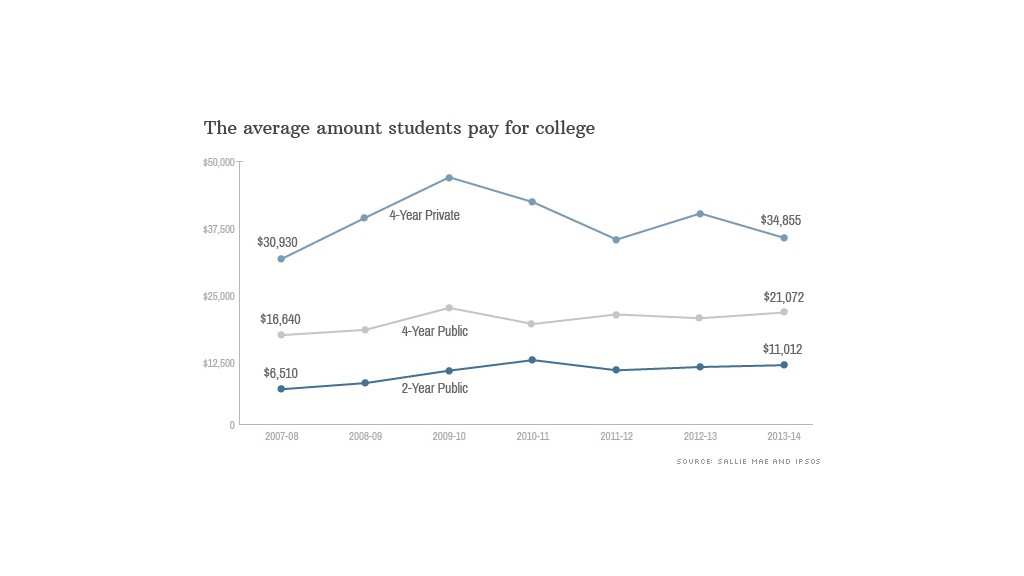

While college costs and student loan bills have soared over the past decade, some students and their families are finding ways to spend (and borrow) less.

Borrowing reached its lowest level in five years as families paid for more expenses out of pocket and cut back on costs in a variety of ways, according to an annual survey of 1,600 college students and parents by Sallie Mae and market research firm Ipsos.

Related: Drowning in student loan debt

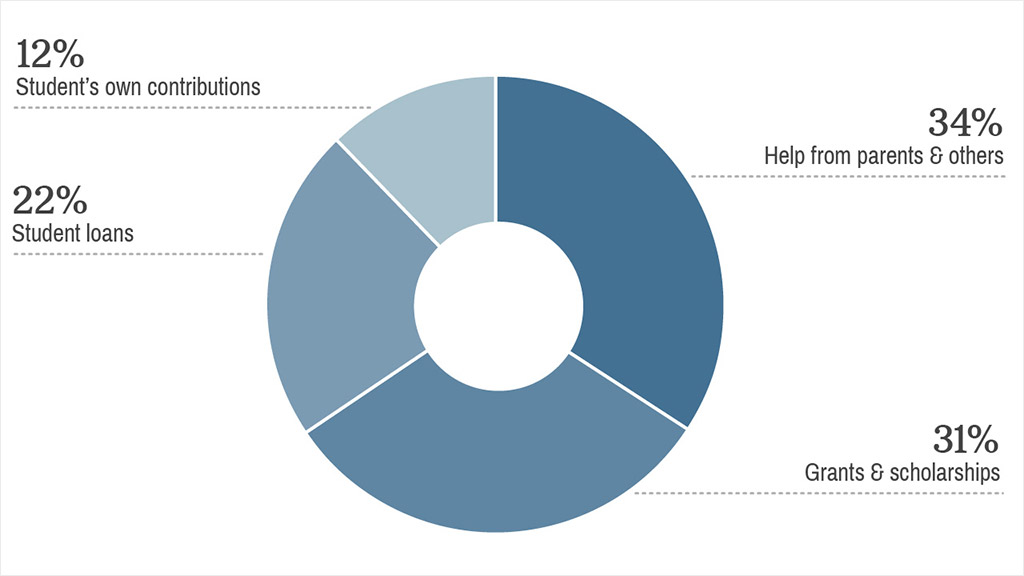

On average, college students and their parents borrowed 22% of total college costs in the 2013-2014 school year, compared to 27% two years ago.

Financial aid experts say that even a small reduction in borrowing can help students save thousands of dollars in future interest payments, and make it more likely that they will be able to afford those payments come graduation.

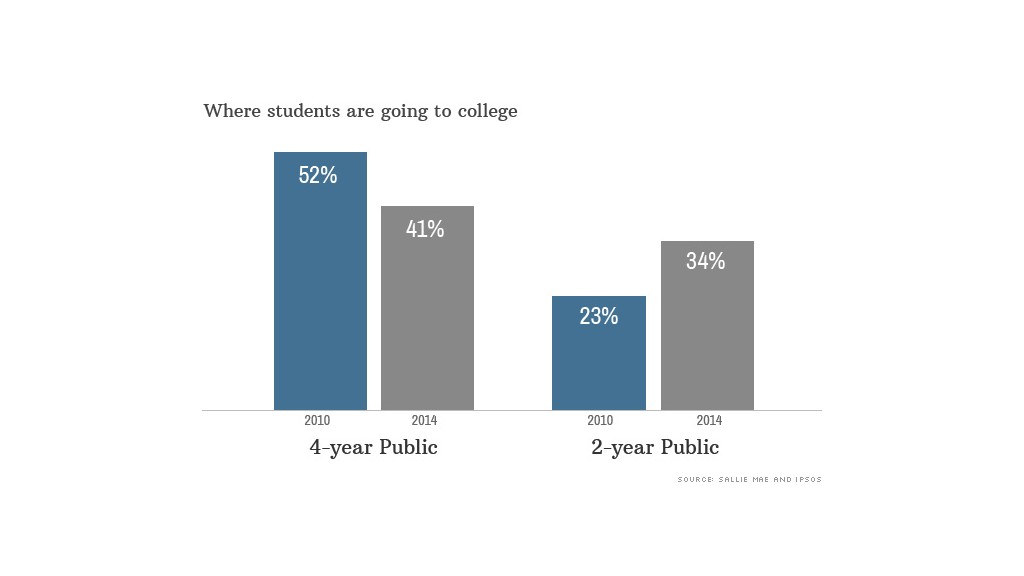

A key factor: a growing percentage of students are seeking to cut costs by attending two-year colleges instead of pricier four-year institutions.

Although the average cost of public two-year schools has nearly doubled in the last six years, these schools are still thousands of dollars cheaper than four-year colleges and universities.

Related: College savings gap widens between rich and poor

But that's not all. The vast majority of students and their families said they were adopting other cost-cutting measures, from choosing an in-state institution (60%) to living at home (54%) to working more hours while in school (48%).

"Families are committed to college and are making deliberate decisions to reduce how much they pay for it," Raymond Quinlan, Sallie Mae's chief executive officer, said in a statement.