Welcome to the first trading day of November.

Here are three things you need to know before the opening bell rings in New York:

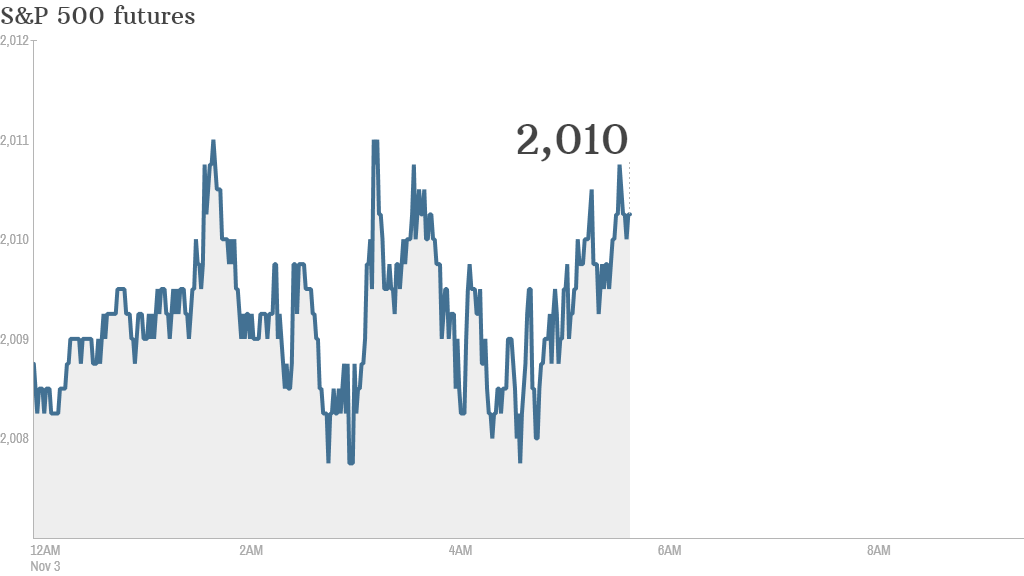

1. Timid trading after stocks hit records: It looks like stocks could start the month on the back foot after October's fireworks. U.S. futures are edging lower and there's a lack of direction in the markets.

European markets were edging lower in early trading. Asian markets ended with mixed results.

October was an explosive month, ending with a bang on Friday. The Dow, S&P 500 and Nasdaq rallied by more than 1% on Halloween. Both the Dow and the S&P 500 closed at record highs and the Nasdaq is at its highest point since the March 2000 Dot-com peak.

The latest reading on the CNNMoney Fear & Greed index shows investors are still feeling fearful, but the extreme fear from mid-October has been shaken out of the markets.

Related: Faster Internet access in the middle of the ocean

2. Earnings: Sysco (SYY) and Sprint (S) will report quarterly earnings before the opening bell. Herbalife (HLF) will report after the close.

L'Oreal (LRLCF) is expected to report after the close of trading in Paris.

HSBC (HSEA) reported earnings in the early morning. Third quarter underlying pre-tax profit fell 12%, in part because the global bank set aside $378 million to cover its exposure to an investigation into alleged rigging of the foreign exchange market. Its shares were about 0.5% lower in London trading.

3. Economics: The ISM Manufacturing Index is set to come out at 10 a.m. ET. At the same time, the U.S. government will report monthly construction spending.

Throughout the day, automakers will be releasing data on October car and truck sales.

New monthly data from HSBC and Markit show the Chinese manufacturing sector is just barely growing. The HSBC Purchasing Managers' Index came in at 50.4 in October, up from 50.2 in September. A number over 50 indicates growth, while a number below 50 indicates contraction.