What does it take to make it into the top 1%?

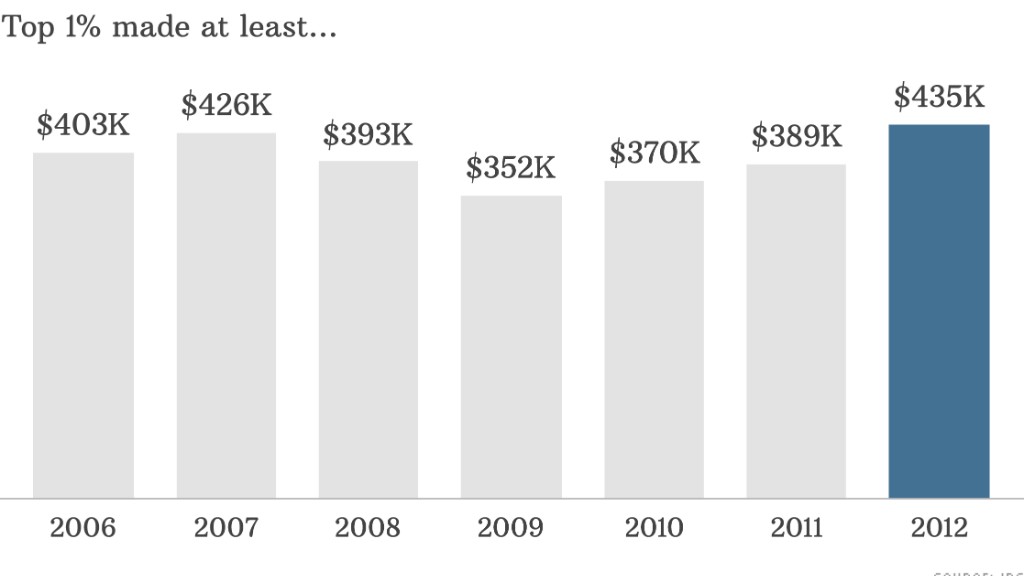

In 2012, it took at least $435,000 in adjusted gross income to be considered one of the fabled top 1% households, according to the latest data from the IRS.

That's a healthy jump from the $389,000 it took the year before, especially considering how low inflation has been in recent years.

Related: The 2014 tax breaks you'll be able to take

The number of people admitted to this exclusive club: nearly 1.4 million households.

Collectively, the top 1% made about 22% of all income reported in 2012, but paid 38% of total federal income taxes collected.

Related: Wealth gap between middle class and rich widest ever

On a per-household basis, however, the average top 1%-er paid just under 23% of their income in federal taxes, which was down slightly from the year before -- and well below the more than 27% the group was paying in 2001.

Since 2012, of course, several tax increases on high-income households have gone into effect as a result of the fiscal cliff deal and the Affordable Care Act.