The next Obamacare controversy is right around the corner.

Obamacare enrollees who received subsidies to help pay for coverage will soon have to reconcile how much they actually earned in 2014 with how much they estimated when they applied many, many months ago.

This will likely lead to some very unhappy Americans. Those who underestimated their income either will receive smaller tax refunds or will owe the IRS money.

That's because subsidies are actually tax credits and are based on annual income, but folks got their 2014 subsidy before knowing exactly what they'd make in 2014. So you'll have to reconcile the two with the IRS during the upcoming tax filing season.

It won't be surprising if many enrollees guessed wrong. The sign up period began in October 2013 and many people did not know what they'd earn in 2014. Some went off what they earned in 2012.

Also, it was up to consumers to report major changes in their circumstances, such as landing a new job or getting married, so their subsidy amounts could be recalculated.

Related: Obamacare premiums: Going up unless you shop

We're not talking chump change. Those who applied through the federal exchange received an average monthly subsidy of $264, according to the most recent figures reported by the Obama administration. They only had to pay $82 a month, on average, for coverage, Roughly 85% of total enrollees received help with insurance premiums. The administration last month said 2014 enrollment was 6.7 million.

Those who underestimated their earnings could owe thousands of dollars, though there is a $2,500 cap for those who remain eligible for subsidies. The threshold for eligibility is based on income - $45,900 for an individual and $94,200 for a family in 2014.

Of course, those who overestimated their 2014 income may get a healthier-than-expected refund. And some will see no change.

Related: Supreme Court to review another Obamacare legal challenge

Here's what happens next:

Obamacare enrollees should receive Form 1095-A from their exchange by Jan 31. It lists who in the household had policies and how much they received in monthly subsidies.

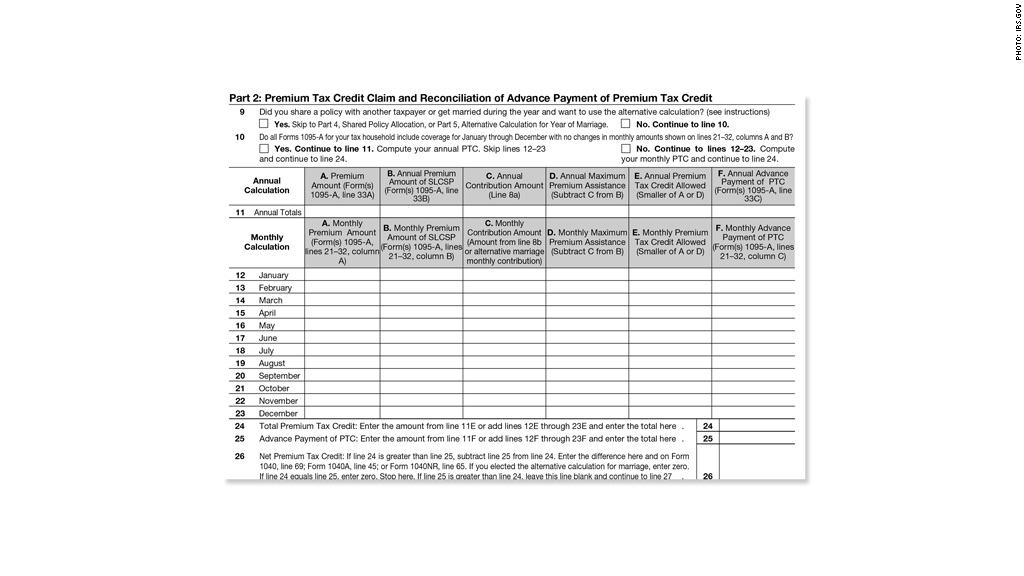

Taxpayers will then use that documentation to fill out Form 8962, which asks details on insurance, subsidies and income. If they were not covered for the entire year, they have to break down the subsidy payments by month.

"It will be very difficult for those individuals who received premium tax credits to prepare their taxes on their own and get this straight," said Timothy Jost, a law professor at Washington and Lee University.

Also concerning is whether the Form 1095-As will contain accurate information and whether the exchanges will send them by the end of January, said Jost, who writes about Obamacare for the Health Affairs blog.

Exchange officials interviewed do not expect there to be problems with their record keeping. The federal exchange is currently testing its process to confirm premium and subsidy amounts with insurers to make sure can generate accurate tax forms.

"Consumers will receive their 1095-A from the [exchange] in the mail and it will be posted to their online healthcare.gov account during tax filing season," said Aaron Albright, a spokesman for the Centers for Medicare & Medicaid Services, which oversees the federal exchange. If there are errors, they can go to healthcare.gov/taxes to get a corrected form.

Covered California, the largest state-based exchange, expects to mail its forms on Jan. 20, said Dana Howard, the exchange's deputy director of communications.

Consumers who have trouble filling out their returns shouldn't expect to get timely help from the IRS. The agency had its budget cut, and its commissioner recently said it may only be able to answer just over half the phone calls received.

"Phone calls won't be answered even as poorly as they were last year," said Roberton Williams, a fellow at the Tax Policy Center.