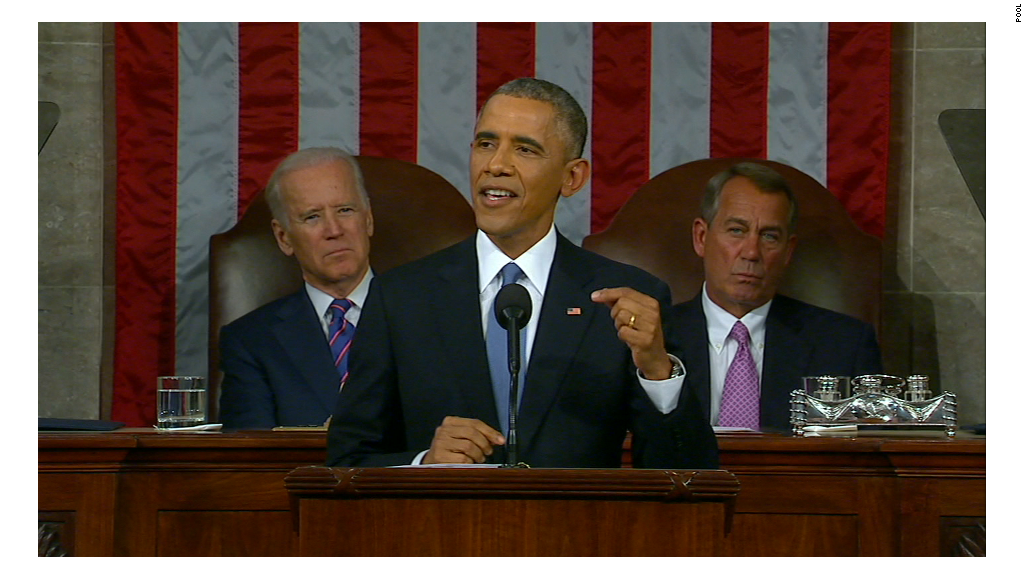

President Obama proposed raising the investment tax rate for high-income households in his State of the Union speech Tuesday evening.

He called for increasing the rates on capital gains and dividends to 28% on high-income households.

The increase would affect couples with incomes over $500,000.

How much of an increase would the rate hike be?

The current long-term capital gains rate is 20% for high-income investors. On top of that, households making more than $200,000 may also be subject to a 3.8% Medicare surtax on some of their investment income.

That makes for a current top rate of 23.8%.

What Obama is doing is proposing an increase in the capital gains rate to 24.2% and then including the 3.8% Medicare surtax for a total top rate of 28%, according to an administration official.

That surtax, which went into effect in 2013, was one of the provisions to help pay for Obamacare.