A handful of former students claiming to be "made poor by the business of education" are protesting their student loans by refusing to pay them.

They're calling themselves the Corinthian 15, named for their number and the now-defunct chain of for-profit schools they attended, Corinthian Colleges.

Corinthian was largely sold off last fall for parts after its practices came under the scrutiny of federal regulators. A lawsuit by the Consumer Financial Protection Bureau accused it of an illegal and "predatory lending scheme," and using falsified job placement figures to "lure" students in.

While its lawsuit is ongoing, the bureau in February negotiated $480 million in forgiveness for Corinthian's private loans, which the bureau said had interest rates twice that of typical student loans and required students to make payments while they were still in school.

But not all students qualified for that program, and even those who did qualify would see only 40% of their debt forgiven.

The Corinthian 15, meanwhile, said the loans they're on the hook for amount to "an immoral system that profits from our aspirations."

"We paid dearly for degrees that have led to unemployment or to jobs that don't pay a living wage. We can't and won't pay any longer," they wrote in an open letter to the federal Education Department, one of several bodies regulating for-profit colleges and student loans.

Related: The debt collector that does the government's dirty work

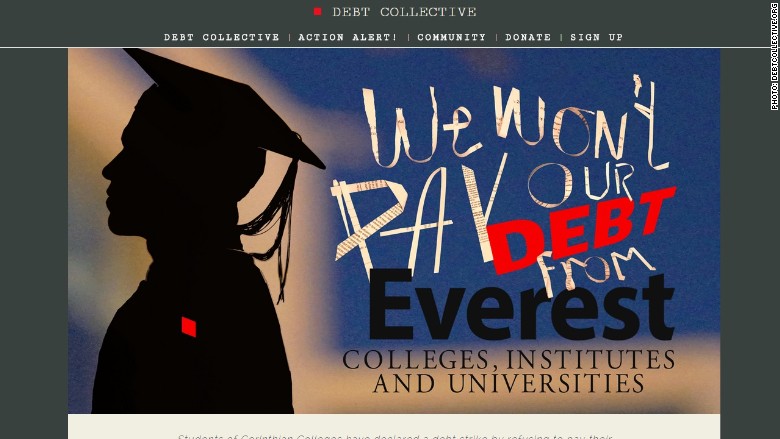

A creditor advocacy group called Debt Collective has taken up the Corinthian 15 cause. Debt Collective, which is an offshoot of Occupy Wall Street, has "erased" more than $13.3 million in student loan debt. (It buys the debt as a collection agency would, then "forgives" the loans by not demanding payment.)

Some of the Corinthian 15 students said in online postings they wanted assistance paying for a more reputable education.

"Many of us who attended Corinthian are in worse financial condition than before we started school," wrote from Florida. "Corinthian and the investors who funded it should be paying our debts, and they should pay for us to get an education from a reputable college that is not-for-profit and that is regionally accredited."

Another, from North Carolina, said, "The Corinthian business model was a high-tech mugging operation."

Before its downfall, Corinthian was one of the largest for-profit colleges in the U.S., and one of many federal regulators began scrutinizing.

The Education Department has since tightened student loan requirements. President Obama has emphasized other forms of higher education, including by proposing two free years of community college.