People rely on their tax refunds.

So it may come as an unhappy surprise to learn that the IRS may legally keep some or all of your refund in at least four situations.

While your refund is about taxes, you could end up losing all or part of it because of non-tax debts you owe the government or court-ordered payments you failed to make, according to Lindsey Buchholz, principal tax research analyst at The Tax Institute at H&R Block.

Delinquent student loans: If you're more than 90 days delinquent on your federal student loan payments and the agency to which those payments are due has given you (or any co-signers on your loan) a chance to cure the situation, it may request that the federal government redirect some or all of your refund toward the balance.

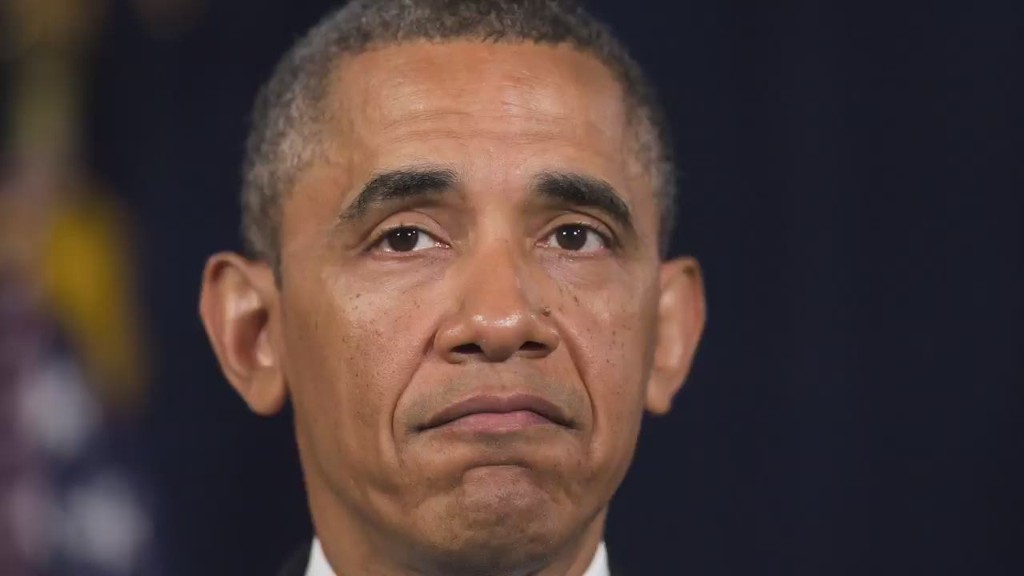

Obamacare payments due: There are two measures in the Affordable Care Act that allow for your refund to be offset.

The first is the penalty you must pay if you failed to buy health insurance coverage during the tax year. If you don't have the money to pay the penalty or if you refuse to pay, the only legal way for the government to collect that money is to withhold as much of your refund as necessary.

The second situation involves any kind of subsidy you may have received to offset the cost of your policy. The subsidy is paid in the form of a tax credit. And as with any other tax credits, if you've received more than you should have, you must pay it back. To reclaim the money, the government may choose to garnish your wages, put a lien on your property or keep some your refund.

Earlier in the tax season, H&R Block reported that 52% of its clients who enrolled in Obamacare had to pay back a portion of their premium credit -- which resulted in an average refund offset of $530.

On the flip side, about a third of those who enrolled found out that they hadn't been paid enough of a premium tax credit, resulting in an average refund increase of $365.

Past-due state income tax: Many elements of your state income taxes are tied to your federal income taxes. For instance, any state income taxes you pay are deductible on your federal return. So if you're delinquent in paying state income taxes, the Treasury may withhold some or all of your refund for the state.

Past-due child support: If a court has ordered you to pay child support and you're behind on payments, a state may first try to garnish your wages or seize property. But it also may make a claim on your refund, which the federal government will collect on its behalf. This might be the case, for instance, if you move away from the state in which the judgment was made.

If you find yourself in any of these circumstances, you should get a heads-up by way of a letter from the Treasury's Bureau of Fiscal Service, which actually issues refund checks. The letter will include your original refund amount as well as the amount that will be offset. It will also include contact information for the agency that will receive the money. That's the agency you should talk to if you think a mistake has been made.

If it turns out you're right -- that your refund shouldn't have been offset because the debt in question has already been paid -- that agency is responsible for paying you back, not Treasury.

If, however, you're wrong, and this year's refund isn't enough to cover your outstanding payments due, your refund next year could be offset too.