I'm in my early 60s and fortunately will be able to retire soon. But I work with a lot of young people who just don't get how important it is start planning early for retirement. They don't even seem to know where to start. I'd like to help them better prepare -- do you have any advice?--Jeff M.

I applaud you for wanting to help your colleagues in their 20s and early 30s, but let's not be too quick to assume they're clueless about retirement. The latest Allstate/National Journal Heartland Monitor Poll did find that young workers are more concerned with immediate needs like paying off student debt and building an emergency fund than retirement. But a new T. Rowe Price study also reports that saving for retirement is important to Millennials and that they're actually doing a pretty good job of balancing current obligations with preparing for retirement.

That said, you raise a good point about the importance of getting a leg up on funding one's post-career life. Waiting just five years to embark on a savings regimen can dramatically downsize the eventual size of your nest egg. Hold off even longer to get going and you could face a seriously diminished retirement lifestyle.

Related: What I learned about my 401(k): A 20-something's guide

So what can you do to help?

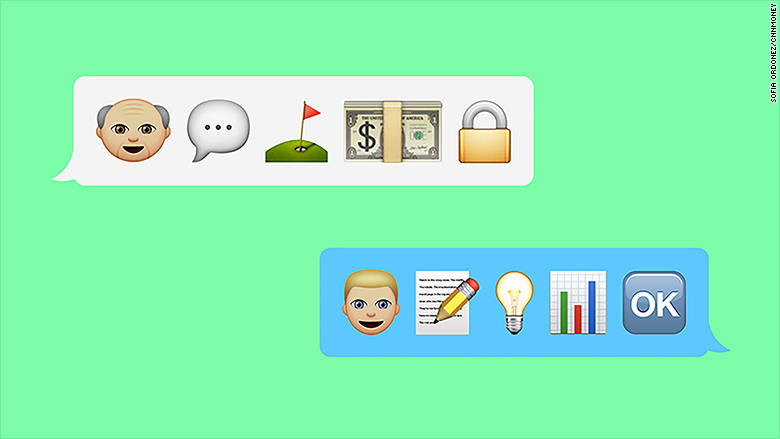

Below, I've outlined four ways you may be able to assist your young colleagues in at least thinking more about preparing for retirement. But before you start proselytizing your fellow workers, a word of caution. For all you know, they may not be particularly interested in getting unsolicited advice from a baby boomer they know only from the workplace. Go easy; try to be sensitive to whether your co-workers really want to hear what you have to say. You don't want to be known as that codger in the office everyone avoids because he's just dying to deliver a lecture on retirement planning.

But if you find someone with a ready ear -- or happen upon a conversation about retirement planning during a coffee break or informal chat -- here are some ways you might help.

1. Give them the benefit of your perspective. The one thing you possess that your colleagues don't is perspective: you know what it's like to be starting out in adulthood and you know what it's like to be facing retirement. What have you learned over that span of time that might help your co-workers? Are there things you might have done differently if you had it to do over again? Saved more? Started saving earlier? How did you cope with multiple demands of saving for a house down payment, paying off school debt, building an emergency fund and retirement? Did you experience disruptions along the way -- layoffs, unexpected expenses, whatever. How did you rebound from setbacks and get back on track?

Your Twenty- and Thirty-something colleagues are probably more adept than you at getting basic information from the plethora of tools and websites that offer retirement-planning help and information. But sharing your insights and personal triumphs and setbacks (yes, you should be open about your misses as well as hits) can make retirement planning less an abstract exercise and more a real-world process, making them more disposed to get involved.

2. Show them the money. If you're 20 or 30, it's hard to imagine how much money you can end up with by the end of a career by saving on a regular basis. Not many of us carry around calculators in our heads. So point them to a tool like the How Fast Will My Savings Grow? calculator that can quickly show them the wonders of compound interest. It takes just a few seconds to see that if you invest, say, $500 today and follow it up with $500 a month over the course of a 40-year career, you can end up with almost $767,000, assuming a modest 5% annual return.

After making the point that saving regularly can add up to significant sums over the course of a career, you can then show why a 401(k) -- with its tax-breaks, automatic payroll deductions and, often, employer matching funds -- is an ideal mechanism to pull off such a long-term savings regiment. You can explain that 15% of salary each year (including any employer matching funds) is a good target to shoot for. But if someone's already trying to build an emergency fund or pay off debts, it's okay to start with a lower percentage, say, 10%, and increase it each year.

For people who don't have access to a 401(k), there's always a traditional or Roth IRA. (This IRA Calculator can tell you which type of IRA you qualify for and which type is best for you.)

Related: Most twenty-somethings are actually saving for retirement

3. Explain that investing needn't be complicated or expensive. Many young people are put off retirement planning because finding the right place to invest their savings just seems so daunting, what with thousands of investing options to choose from. But as someone who's managed to create a decent sized nest egg over the years, you should be able to explain that truly smart investing is also simple. You create a mix of stocks-bonds based on your age and risk tolerance -- which generally means investing 70% to 90% of your savings in stocks early in your career -- and pretty much leave it alone except to rebalance periodically.

To keep costs down and improve your chances of building a sizeable nest egg, stick to low-cost investing options like broad stock and bond index funds. Or, for an even simpler solution, you could always suggest that your younger colleagues choose a target-date retirement fund, an option that gives you a ready-made diversified mix of stocks and bonds and gradually makes that mix more conservative as you age.

4. Tell them to chill. Young investors can easily get the impression that they need to shift their retirement strategy every time the market dives or soars. But as someone who's been through bull and bear markets, recessions and expansions, you can explain to your young co-workers that the more moves you make, the greater the chance you'll make mistakes. You can't outsmart the markets.

You do, however, want to stress to your colleagues the importance of keeping track of their progress. They can do that by going to a good retirement income calculator and plugging in such info as their current salary, savings rate and retirement account balances. They don't need to do this often -- about every year or so is fine. But it's important to keep tabs and, if necessary, take action early to avoid having to make more drastic, and painful, changes later on.

You can only do so much to assist your colleagues. At the end of the day, they have to sign up for their 401(k) plan or other retirement account, contribute the savings to fund it and invest it in a way that will allow their nest egg to grow without taking on too much risk. But if you're able to get across the four tips I've outlined, then you'll know that at least one boomer has made a good-faith effort to give a younger generation a better shot at financial security down the road.

More from RealDealRetirement.com

Should I Invest 100% of My Retirement Savings In Stocks?

4 Signs You May Be Addicted To Financial Porn