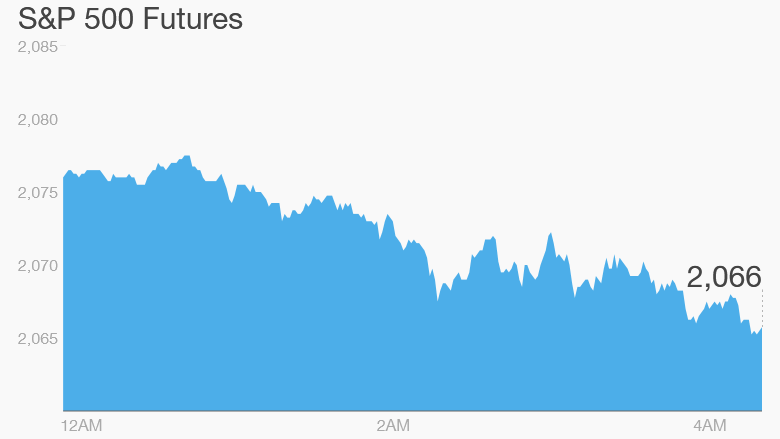

Investors are bracing for a bruising session Thursday.

U.S. stock futures were falling and global markets are awash with red.

Here are the 5 things you need to know before the opening bell rings in New York:

1. Oil slides: Crude prices are under pressure, losing 0.7% to hover just below $41 a barrel, after plunging to a six-year low on Wednesday. Oil has been falling in recent weeks as the supply glut worsens and demand remains sluggish. Weak oil is ringing alarm bells for investors about the health of the global economy.

Related: Why oil prices could sink below $15 a barrel

And the latest victim of low oil prices? Kazakhstan. Its currency plunged 23% after the country's government allowed the tenge to float freely in an attempt to blunt the impact of falling crude prices.

2. China tumbles: Another day, another wild ride for Chinese investors. The Shanghai Composite closed down 3.4% and the smaller, tech-heavy Shenzhen index lost 3%.

Volatility has dominated trading in China over the summer and prompted Beijing intervene to stabilize markets.

Related: Fear factor: Why China scares investors

3. Earnings updates: A batch of results are due before the market open, including Tech Data (TECD), Sears (SHLD), Madison Square Garden (MSG), Stein Mart (SMRT) and Kirklands (KIRK). This afternoon, Hewlett-Packard (HPQ), Gap (GPS) and Ross (ROST) are due to provide earnings updates.

4. Economic reports: Plenty to watch out for on the economic front, beginning with the federal government's weekly jobless claims at 8:30 a.m. ET.

The National Association of Realtors releases July home sales figures at 10 a.m. ET. Sales surged in June, but analysts don't expect the trend to continue.

Also at 10 a.m., the Philadelphia Fed will post its business outlook survey for August. Last month there were signs manufacturing was slowing down, and unemployment data wasn't favorable.

Related: Get ready for a rate hike, Fed looks close to liftoff

5. International markets overview: European markets were losing ground in early trading, with a 0.6% fall for Germany's DAX index. In London, the FTSE index shed 0.5%, pushing the index into correction territory.

Greece received its first chunk of an 86 billion euro ($95 billion) bailout, meaning the country can make a big debt repayment to the European Central Bank and provide some much-needed cash to its battered banks. Stocks in Athens lost 1%.

It was a weak session for Asian markets. Chinese markets led the declines, while Japan's Nikkei index retreated 0.9%.

The falls follow a downbeat finish for U.S. stocks Wednesday. The Dow Jones industrial average gave up 0.9%, while the S&P 500 and the Nasdaq lost 0.8%.