Investors may be suffering from whiplash but they should get some more pain relief Thursday.

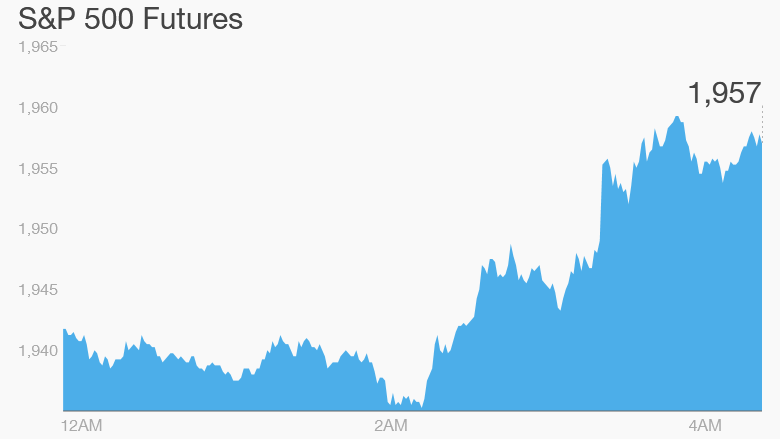

U.S. stock futures were pushing higher, and global markets were bouncing as panic over China's stock market crash eased.

Here are the five things you need to know before the opening bell rings in New York:

1. Global markets rally: Markets around the world rebounded after days of wild trading. China's benchmark Shanghai Composite jumped 5.3%, and Japan's Nikkei index closed up 1.5%. European markets notched solid gains in early trading.

Worries about Chinese growth and huge falls on its share markets triggered waves of selling around the globe this week, but the panic receded Thursday, helped by soothing words from central bankers.

Related: Global markets rebound as panic eases

China slashed interest rates earlier this week, hoping the move would stabilize the economy and ease fears that the country is slowing sharply.

Related: China's crash...in 2 minutes

2. Oil jumps: The positive tone also washed over to crude markets. Oil surged 4% to trade back above $40 a barrel. Concerns about waning demand and oversupply has slugged crude in recent months, and the commodity is down nearly 25% since the start of this year.

3. Earnings and economics: A slate of companies including Tiffany & Co (TIF), Dollar General (DG), Burlington Stores (BURL) and Michaels (MIK) are reporting quarterly earnings before the open. Gamestop (GME), Ulta (ULTA), and Aeropostale (ARO) are among the firms reporting after the close.

Federal Reserve policymakers kick off their annual meeting in Jackson Hole, Wyoming on Thursday. The three-day affair will be closely watched for hints about when to expect an interest rate hike. New York Fed President William Dudley said Wednesday the case for a September hike had become "less compelling."

Data to watch includes the second estimate of U.S. second quarter GDP, due out at 8:30 a.m. ET. New weekly jobless claims numbers are also out at 8.30am ET.

4. Market movers: Transocean (RIG) is one stock to keep an eye on Thursday. As crude prices jumped, shares in the oil services firm are rising 4% premarket. Online streaming outfit Netflix's (NFLX) stock is also up 4%.

5. Europe gains: European markets were caught up in the global rebound in early trade, with Germany's DAX index climbing 2.8% and France's CAC up 2.4%.

Drinks giant Pernod Ricard (PDRDF) was one notable laggard. Shares in the owner of Absolut Vodka and Chivas Regal slid 2.6% in Paris after profits disappointed.

Spain's economy continued to impress, with data confirming the annual rate of growth accelerated to 3.1% in the second quarter. The local IBEX index traded up 2.4%.

Related: Europe's bailout economies are booming. Except Greece

The global rally follows a strong rebound on Wall Street Wednesday. The Dow Jones industrial average jumped 4%, while the S&P 500 put on 3.9%, and the tech-heavy Nasdaq surged 4.2%.